How to do app market research in 7 steps

With over 5 million apps across the App Store and Google Play, skipping app market research isn’t just risky, it’s a fast-track to getting buried.

App market research is the systematic process of gathering, analyzing, and interpreting data about your target market, competitors, and user needs to make informed decisions about your mobile app strategy. Whether you’re validating a new app idea, planning a feature update, or expanding into new markets, effective market research reduces risk and maximizes your chances of success.

Understanding your market isn’t optional—it’s essential for survival and growth.

This comprehensive guide will walk you through everything you need to know about conducting effective app market research, from foundational concepts to advanced techniques that leading mobile companies use to stay ahead.

Key takeaways

- Treat market research as an ongoing discipline, not a pre-launch task. The best app teams revisit research regularly to track competitors, evolving user needs, and shifting category trends.

- Define research questions that tie directly to decisions. Every data point should help you answer something concrete—like which feature to build, what price to test, or which market to enter first.

- Balance breadth with depth. Start broad with secondary data (market reports, store insights), then go deep with primary methods such as user interviews, surveys, or prototype tests.

- Use frameworks to quantify opportunity. The TAM–SAM–SOM model helps translate big ideas into measurable potential and keeps forecasts realistic.

- Validate demand early through keyword and ASO data. Search trends, competition scores, and review sentiment reveal whether real users are already looking for your solution.

- Understand users beyond demographics. Combine behavioral data with psychographic insights to uncover what motivates them—and how they make app-related decisions.

- Leverage AI to scale insight. Automated monitoring, sentiment analysis, and predictive modeling can reveal shifts faster than manual methods, but always validate machine findings with human judgment.

- Use trusted tools to stay current. Platforms like AppTweak’s Market Intelligence centralize competitive data, keyword trends, and performance benchmarks—helping teams make informed decisions faster.

What is app market research?

App market research is the systematic collection and analysis of data about your target market, competitors, and potential users to inform mobile app development and marketing decisions. Unlike general product research, app market research focuses specifically on mobile user behavior, app store dynamics, monetization patterns, and platform-specific considerations.

With this research you should be able to answer questions like: Is there demand for your app idea? Who are your competitors? What monetization model will work best? Which markets should you prioritize?

App market research differs from traditional product research in several key ways:

- Platform constraints: Mobile apps must work within app store guidelines and platform limitations

- Discovery mechanisms: Users find apps primarily through app stores, not traditional marketing channels. Although ChatGPT might be expanding app discovery.

- Monetization complexity: Apps can use freemium, subscription, in-app purchases, or advertising models

- User behavior patterns: Mobile usage is often contextual, brief, and location-dependent

- Rapid iteration cycles: Apps can be updated frequently, requiring ongoing market validation

Why is app market research important?

Effective app market research provides the foundation for every major decision in your app’s journey. Here’s why it matters:

Validate demand before development

Market research helps you confirm there’s genuine demand for your app concept before investing significant time and resources. By analyzing search volume for relevant keywords, examining competitor download estimates, and conducting user interviews, you can gauge whether enough people have the problem your app solves.

Expert Tip

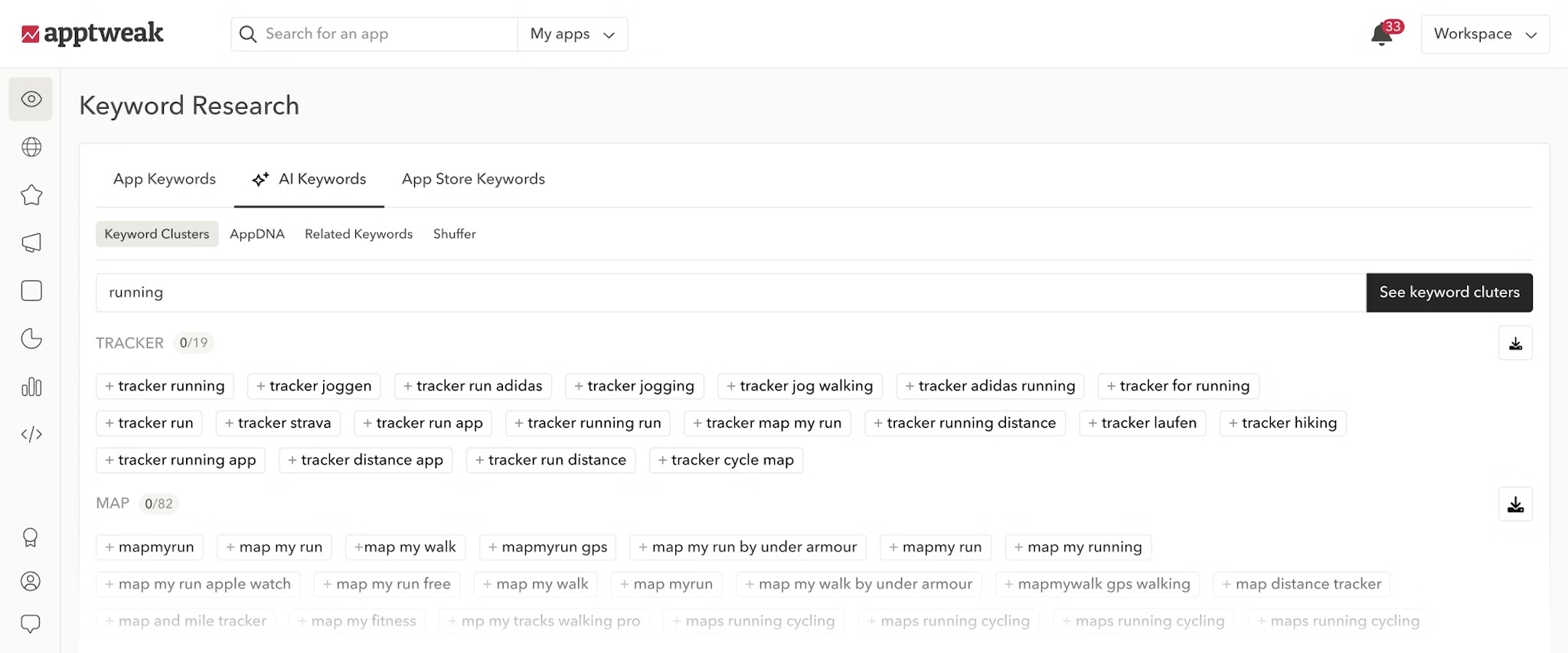

Use AppTweak’s Keyword Explorer, which is powered by AI to help you surface discovery keywords, high-volume generic keywords, branded keywords, and high-relevancy keywords.

[/tip]

Understand your competitive landscape

Competitor analysis reveals market gaps and positioning opportunities. By studying top-performing apps in your category, you can identify:

- Features that users consistently request in reviews

- Monetization strategies that work (and don’t work)

- App Store Optimization tactics that drive organic growth

- Pricing models and user acquisition approaches

Size your market opportunity

Market sizing helps you understand the revenue potential and set realistic growth targets. Using the TAM/SAM/SOM framework:

- Total Addressable Market (TAM): Everyone who could theoretically use your app

- Serviceable Addressable Market (SAM): Users you can realistically reach

- Serviceable Obtainable Market (SOM): Market share you can capture

Inform monetization strategy

Research reveals which monetization models resonate with your target users. Different user segments respond differently to freemium vs. subscription vs. one-time purchase models. Market research helps you choose the approach that maximizes both user adoption and revenue.

Reduce development risk

Data-driven decisions minimize the risk of building features users don’t want. By validating concepts early through surveys, interviews, and prototype testing, you can pivot before significant development investment.

Types of app market research

Understanding different research types helps you choose the right approach for your specific questions and constraints.

Primary vs. secondary research

Primary research involves collecting new data directly from your target audience through surveys, interviews, focus groups, or app analytics. This provides unique insights specific to your app and market position.

Secondary research uses existing data sources like industry reports, competitor analysis, app store intelligence, and published studies. This is typically faster and less expensive than primary research.

For example, a fitness app might run interviews to learn why users abandon workout plans (primary), then use industry reports to validate whether that behavior reflects global fitness trends (secondary).

The sweet spot? Start broad with secondary data to frame the landscape, then use primary research to dig deeper into your specific opportunity.

Qualitative vs. quantitative research

Qualitative research explores the “why” behind user behavior through interviews, focus groups, and open-ended survey questions. It’s ideal for understanding user motivations, pain points, and feature preferences.

Quantitative research measures the “what” and “how much” through surveys, analytics, and statistical analysis. It helps you quantify market size, feature demand, and pricing sensitivity.

Example: Qualitative research might reveal that users find budgeting apps “overwhelming,” while quantitative research shows that 73% prefer apps with fewer than 5 main features.

Exploratory vs. evaluative research

Exploratory research helps you discover new opportunities, understand broad market trends, or generate hypotheses. Use this when entering a new market or brainstorming features.

Evaluative research tests specific concepts, features, or strategies against defined criteria. This is crucial for validating app concepts, testing pricing models, or choosing between design alternatives.

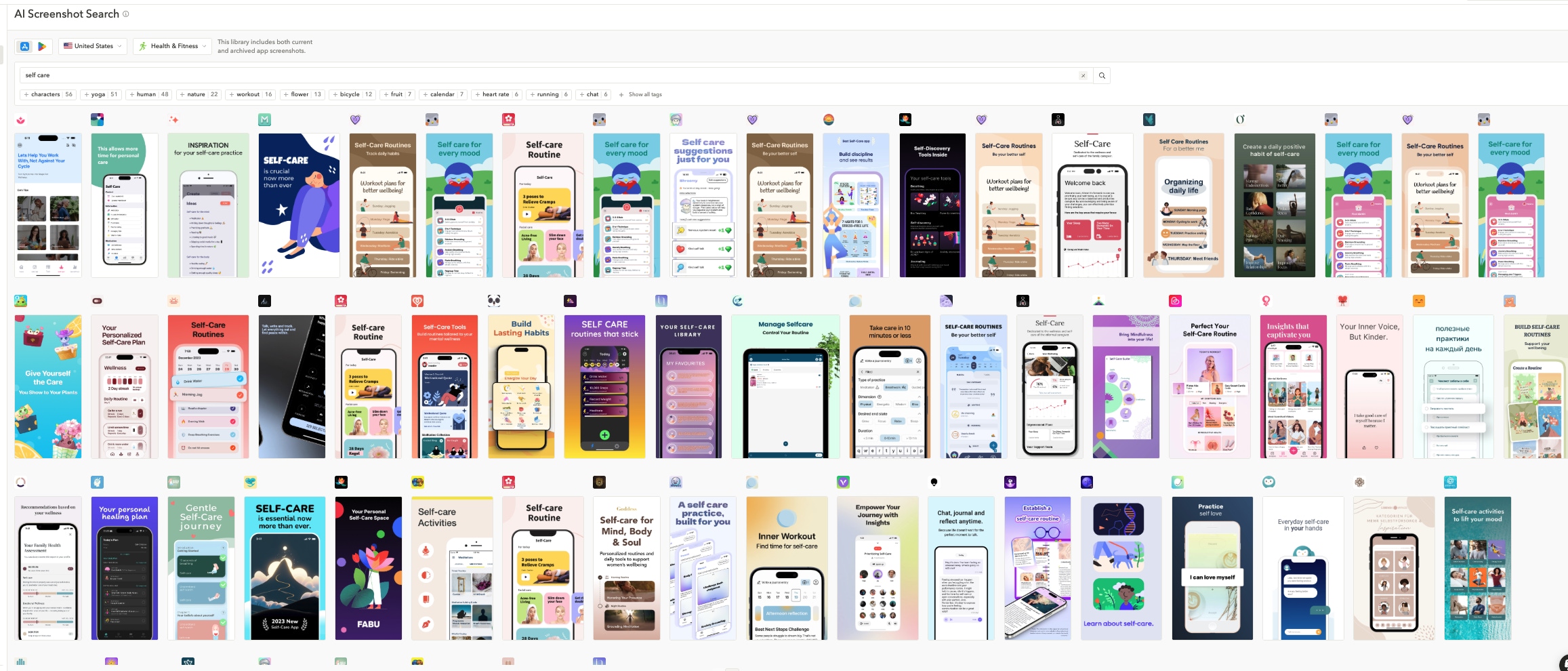

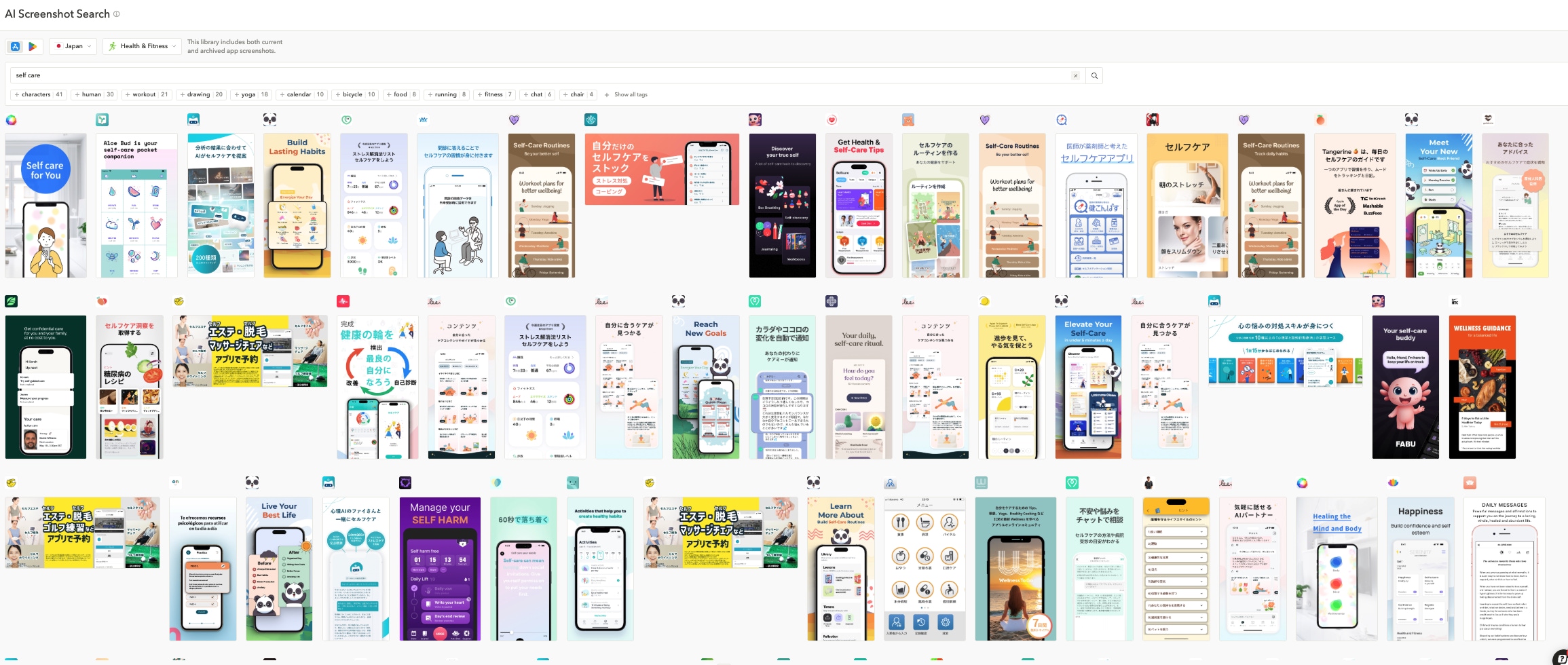

Take a wellness app: at the ideation stage, it could explore what “self-care” means across cultures to identify unmet needs. Later, it might evaluate two feature prototypes—guided audio vs. text-based routines—to see which drives higher engagement. Below we looked at two different cultures—the U.S. and Japan—to see how the culture impacted app store screenshots

So, searched within AppTweak’s AI Screenshot Search for the term “self care” and compared the results from the U.S. and Japan.

By researching the differences, we can see that self care apps in Japan tend to emphasize structure, balance and guided routines with visuals that are orderly and framed around measurable progress.

In contrast, U.S. apps spotlight individuality and emotional empowerment: bolder colors, motivational quotes, and human-centric imagery reinforce a message of self-expression and personal growth. This example reinforces the importance of app market research.

Attitudinal vs. behavioral research

Attitudinal research captures what users say they want or would do through surveys and interviews. This reveals preferences, intentions, and perceptions.

Behavioral research observes what users actually do through analytics, A/B tests, and usage data. This often reveals gaps between stated preferences and actual behavior.

Expert Tip

Users often say they want comprehensive features but actually prefer simple, focused apps. Always validate attitudinal findings with behavioral data when possible.How to conduct app market research: 7-step process

Follow this systematic approach to conduct thorough app market research that informs strategic decisions.

Step 1: Define your research objectives

Start by clarifying exactly what you need to learn and how you’ll use the insights. Vague objectives lead to unfocused research that doesn’t drive decisions.

Common research objectives include:

- Validate demand for a new app concept

- Identify the most valuable features to build

- Choose between monetization models

- Size the market opportunity in specific countries

- Understand why users churn from competitor apps

- Determine optimal pricing for premium features

Create specific, measurable questions like:

- “What percentage of our target users would pay $4.99/month for premium features?”

- “Which of these 5 features would drive the highest user retention?”

- “How large is the market for meditation apps in Germany?”

Define success criteria upfront: Establish thresholds that will inform go/no-go decisions, such as minimum market size requirements, acceptable competitive intensity levels, or required user willingness-to-pay percentages.

Step 2: Analyze your competitors

Competitive analysis provides crucial context for your market position and reveals opportunities for differentiation.

Identify your competitor set across three categories:

- Direct competitors: Apps solving the exact same problem with similar approaches

- Indirect competitors: Apps addressing the same user need through different methods

- Aspirational competitors: Market leaders whose strategies provide useful benchmarks

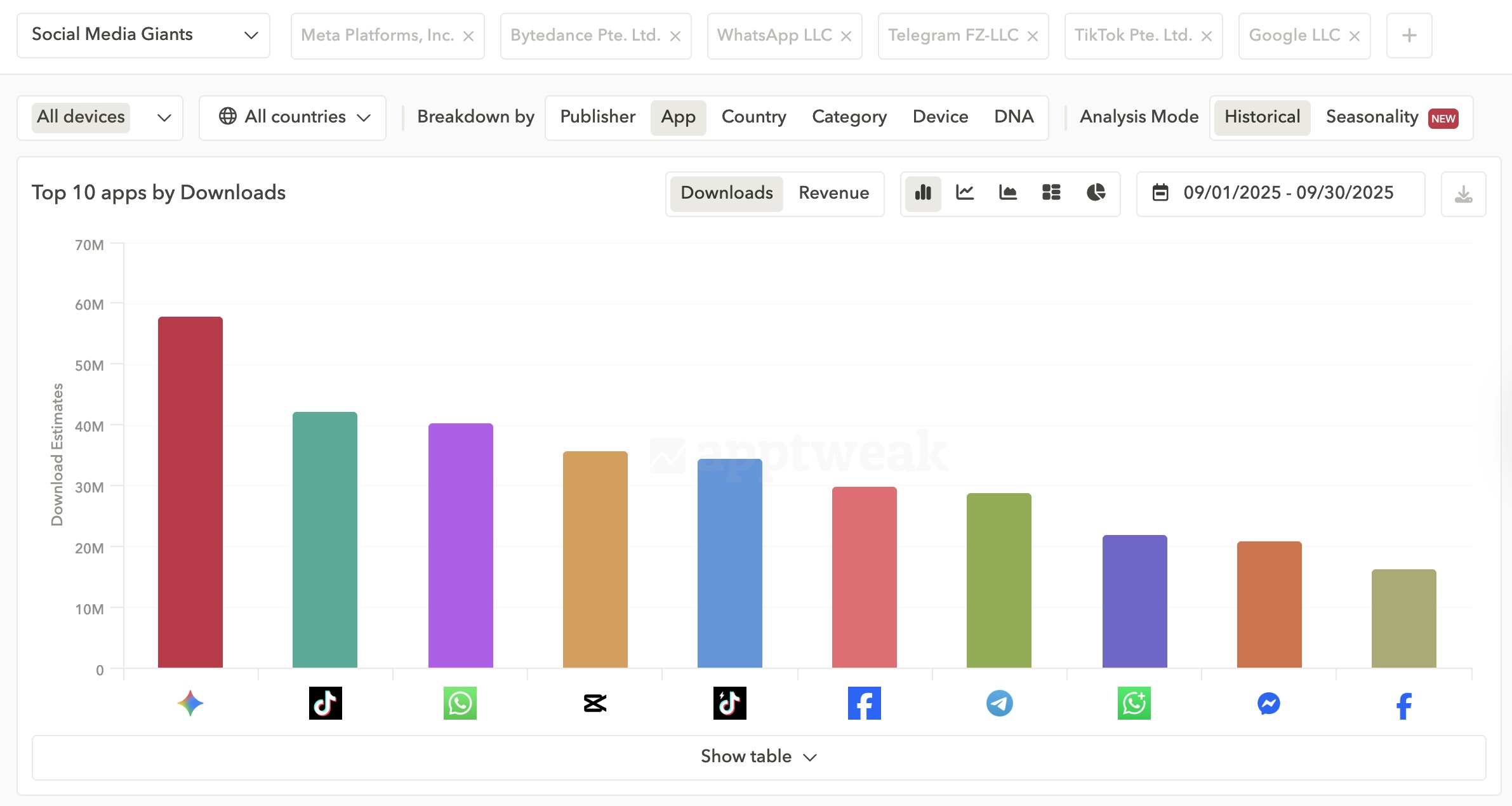

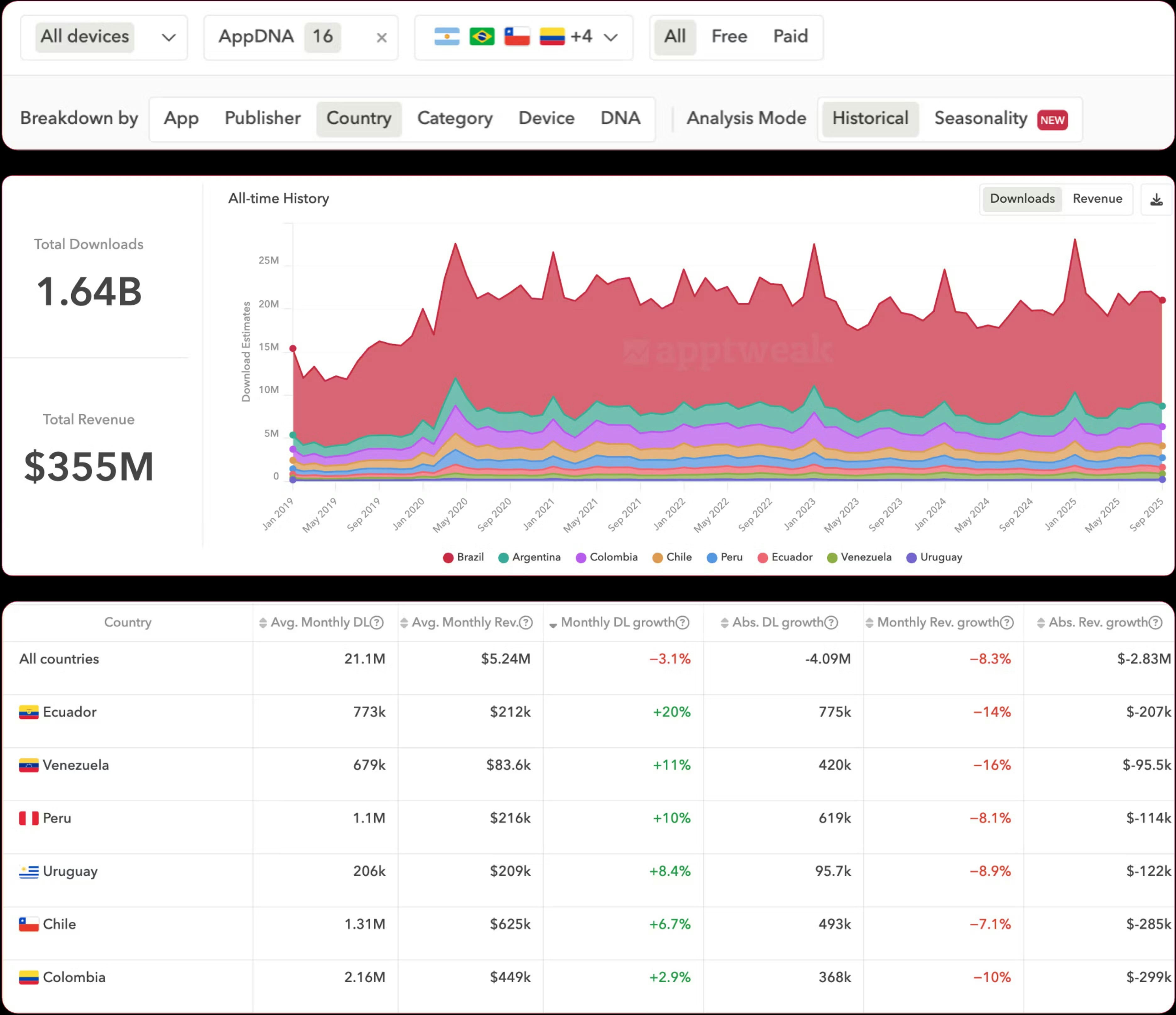

AppTweak’s Market Intelligence enables you to visualize download and revenue trends across countries and categories, revealing growth gaps and opportunities competitors miss. The platform allows you to benchmark competitors’ downloads, revenues, and release velocity while identifying leading publishers and rising categories. With access to over 100 countries and detailed performance metrics, you can track market dynamics in real-time and spot emerging threats before they become major competitors.

Access niche subcategories through AppDNA and GameDNA: AppTweak’s proprietary taxonomies classify apps into 200+ app types and 70+ game genres, providing precision far beyond the app stores’ 20-30 broad categories. This granular classification helps you identify true competitive peers and discover whitespace opportunities in overlooked niches.

Map out your competitors on a matrix

It’s paramount to document your competitor research. We suggest building a comprehensive database using the following competitor matrix template.

| Competitor | Core features & functionality | Monetization Model | ASO strategy | User feedback patterns | Release cadence | User acquisition approach |

|---|---|---|---|---|---|---|

| App A | List main features and any unique capabilities compared to others. | Note pricing model (Freemium, Subscription, IAP, one-time purchase) and any trial periods or tier details. | Track main keywords, current rankings, metadata updates, screenshots, and icon/creative trends. | Summarize rating average, recent sentiment, recurring complaints or feature requests. | Note update frequency (e.g., weekly, monthly), velocity of new features, and seasonal release spikes. | Outline paid vs. organic mix (Apple Search Ads, social, influencer, partnerships, cross-promotions). |

| App B | ||||||

| App C | ||||||

| App D |

Don’t forget to look at competitors’ reviews

Review mining with AI tools can reveal user sentiment patterns. For example, if users consistently complain about “complicated setup” in competitor reviews, you’ve identified a differentiation opportunity.

Expert Tip

Use AppTweak’s App Power index to classify competitors by market strength. This quantitative approach (0-100 scale) helps you identify direct rivals, market leaders, and emerging threats based on category downloads and competitive positioning.Step 3: Size your market opportunity

Market sizing estimates your revenue potential and helps prioritize which markets to enter first.

Follow the TAM/SAM/SOM framework

This classic framework helps you estimate your app’s market potential by breaking it into three layers of opportunity: from the broadest universe of possible users to the realistic share you can capture.

Total Addressable Market (TAM):

- Start with broad demographic data (e.g., “smartphone users aged 25-45”)

- Apply category-specific usage rates (e.g., “30% use fitness apps”)

- Calculate: Total users × category penetration × average revenue per user

Serviceable Addressable Market (SAM):

- Narrow to users you can realistically reach through your channels

- Consider geographic, language, and platform constraints

- Factor in your go-to-market strategy limitations

Serviceable Obtainable Market (SOM):

- Estimate realistic market share based on competitive analysis

- Consider your resources, timeline, and differentiation

- Typically 1-5% of SAM for new entrants, 0.5-2% in first year

Example calculation for a fitness tracking app:

- TAM: 50M smartphone users × 20% fitness app usage × $30 annual spend = $300M

- SAM: 10M users in target countries with iOS/Android = $60M

- SOM: 2% market share achievable = $1.2M annual opportunity

Account for market dynamics Consider growth rates, seasonality patterns, and saturation levels.

Growth rate often matters more than size. For example, a niche with a $10 million total addressable market growing 50% each year becomes a $76 million opportunity in just five years — far more dynamic than a $100 million market that isn’t growing at all. For new entrants, chasing acceleration could beat chasing scale.

Use multiple estimation methods to triangulate:

- Top-down approach: Start with total market size and narrow to your segment

- Bottom-up approach: Calculate from keyword search volumes and conversion rates

- Value theory approach: Estimate based on willingness to pay research

Tool spotlight: Try Market Intelligence for free

To analyze market trends and size opportunities, check out AppTweak’s next-gen Market Intelligence. Inside you can get free app download and revenue estimates for apps and publishers, including past-month totals.

AppTweak’s Market Intelligence visualizes download and revenue trends across 100+ countries and categories, revealing growth gaps and rising players your competitors might miss.

You can benchmark apps or publishers, track portfolio shifts, and explore niche subcategories through AppDNA and GameDNA — AppTweak’s proprietary taxonomies that classify apps into 200+ types and 70+ game genres. It’s the fastest way to identify where your next opportunity actually exists.

Step 4: Validate demand through keyword and ASO research

Keyword research reveals actual user demand by showing what people search for in app stores and on Google.

Use AppTweak’s keyword research tools to:

- Analyze search volume for terms related to your app concept

- Identify trending keywords in your category

- Study competitor keyword strategies and ranking positions

- Discover long-tail opportunities with lower competition

Study Downloads to Top metrics to estimate how many daily downloads an app needs to reach specific ranking positions in your target categories and countries. This helps you set realistic growth targets and prioritize markets where you can gain traction more efficiently.

Key metrics to track:

- Search volume: Monthly searches for relevant terms

- Competition level: How many apps target each keyword

- Chance score: Your likelihood of ranking for specific terms, AppTweak’s proprietary metric

- Seasonal trends: When demand peaks throughout the year

Demand validation signals

When validating demand, look for clear signs that users are actively searching for solutions like yours. Prioritize keywords with high or rising search volume scores as these indicate meaningful demand within your category.

Sustained upward trends over several months point to long-term interest rather than a short-lived spike. If multiple successful apps already rank for similar terms and maintain strong ratings, that’s further proof of healthy market demand. Finally, keep an eye on engagement signals such as review volume and rating velocity as rapidly increasing reviews usually point to an active, growing audience.

Map keywords to user intent stages:

- Discovery stage: Problem-focused keywords (“how to track expenses”)

- Consideration stage: Solution-focused keywords (“best budget tracker app”)

- Decision stage: Branded and comparison keywords (“Mint vs YNAB”)

Step 5: Understand your target users

User research reveals who your customers are and what drives their behavior, preferences, and decision-making.

Develop detailed user personas through:

- Demographic research

- Psychographic analysis

- Behavioral insights

- User interviews and surveys

- Review mining

- Social media listening

Your app lives or dies by how well you understand the people using it. This is where research shifts from numbers to nuance—where data becomes empathy. Before building features or setting prices, you need to know who your users are, what drives them, and how they make decisions.

Go beyond demographics

Look at the full context of your users’ lives. Age, gender, income, and device preferences are starting points, but not the story. Ask what categories they use most often, how comfortable they are with new technology, and how much they typically spend on apps. These patterns reveal accessibility needs, platform priorities, and purchase power that should shape both product design and go-to-market strategy.

Utilize Psychographics

Psychographics reveal why users behave the way they do—their motivations, values, and pain points. Do they use your app to save time, reduce stress, or achieve a personal goal? Understanding these emotional drivers helps you position your app not just as a tool, but as a solution that fits seamlessly into their lifestyle. For example, a meditation app user might “hire” the app to calm down before bed, while another uses it to stay focused during work. The difference seems subtle, but it can completely change your feature roadmap and messaging.

Don’t underestimate behavioral data

Behavior shows how people actually interact with apps, which often differs from what they say they do. Study discovery patterns (where users first hear about your app), session frequency, and the times of day they engage most. Track feature usage and churn behavior to identify what keeps users coming back—or makes them leave. This behavioral data grounds your decisions in reality rather than assumptions.

Combine research methods to get a 360-degree view. Use interviews for depth, surveys for scale, and review mining for candid feedback. Social listening on platforms like Reddit or X can surface raw, unfiltered opinions about your category. The magic happens when you layer these perspectives—seeing where qualitative insight meets quantitative validation.

Expert Tip

Utilize the jobs-to-be-done framework: Focus on what users are trying to accomplish rather than demographic segments. For example, users “hire” a meditation app to “quickly calm down during a stressful workday” or “establish a consistent mindfulness practice.”Step 6: Test monetization and pricing models

Monetization research helps you understand how users prefer to pay—and what price points balance adoption with revenue growth. The goal isn’t just to pick a payment model; it’s to align pricing with perceived value and user expectations. Testing early prevents costly mistakes later, when pricing inertia sets in.

There’s no single “best” monetization model. What matters is how well it matches your product’s value delivery and user behavior.

Review the types of monetization models

See which of the following monetization models makes most sense for your app.

Freemium models offer a free core experience with premium upgrades or extra content available via in-app purchases. A freemium model is ideal for apps that can clearly separate basic and advanced tiers. Conversion rates often hover around 2-5%, but they can climb when premium features solve high-intent problems.

Subscriptions create predictable revenue streams through recurring monthly or annual payments—perfect for apps offering ongoing content or services, such as fitness, education, or productivity platforms. Success here depends on retention and lifetime value optimization, not just initial conversions.

A one-time purchase model provides some apps with better performance. It’s a simple, upfront payment that grants full access. It’s straightforward for users but limits long-term revenue potential, so it tends to suit utility tools or self-contained games.

Advertising remains a common choice for free apps targeting large audiences. Ad-supported models can generate solid income at scale and often work best in hybrid form, paired with a freemium or IAP strategy.

In-app purchases (IAPs) are the transaction layer behind several monetization strategies. While not a standalone model, IAPs allow users to buy upgrades, consumables, or extra content directly inside the app—whether that’s a subscription unlock, a cosmetic item in a game, or a premium feature in a paid tool. Because they’re flexible and familiar to users, IAPs often complement other approaches like subscriptions or advertising, helping developers diversify their revenue mix.

Find the optimal price using one of these pricing research methods

Once you’ve identified the right model, research helps you find the optimal price. Consider the following ways to uncover the price point that’s best for your app.

Van Westendorp Price Sensitivity Meter:

- Survey users with four questions about price perceptions

- “At what price would this app be too cheap (questioning quality)?”

- “At what price would this app be a bargain (good value)?”

- “At what price would this app be getting expensive?”

- “At what price would this app be too expensive?”

- Identify optimal price range and psychological barriers

Conjoint analysis or MaxDiff:

- Present users with feature/price combinations

- Identify which attributes drive purchase decisions

- Optimize feature bundles and pricing tiers

- Determine relative value of different features

Competitive price benchmarking:

- Map pricing across top 10-20 competitors

- Identify pricing clusters and positioning gaps

- Understand what features justify premium pricing

- Test how your pricing compares to alternatives

A/B testing (post-launch or with prototype):

- Test different price points with real users

- Measure conversion rates and lifetime value

- Optimize based on actual purchase behavior

- Consider localized pricing for different markets

A few tactical considerations can make or break your results. Experiment with trial periods (for example, 3-, 7-, or 14-day free trials) to see where conversion peaks. Test paywall placement—whether to gate features immediately, after a moment of value, or through progressive disclosure.

Always use localized pricing that reflects purchasing power in each market; simple currency conversions rarely work. And if you offer both monthly and annual plans, remember that yearly bundles typically perform best when priced at a 20–40 percent discount.

In short, effective monetization research blends strategy and experimentation. Start with a clear hypothesis about how users value your app, then test it with real data. Pricing isn’t a one-time decision. It’s a living part of your growth strategy that should evolve as your audience, competition, and product maturity change.

Step 7: Synthesize findings and make decisions

Once your research is complete, the real work begins: turning insights into action. This final step is about translating everything you’ve learned into a clear, data-backed strategy your team can align around. The goal isn’t to produce another presentation—it’s to make confident, evidence-based decisions about what to build, who to serve, and how to grow.

Summarize your research insights

Begin with a concise research summary that distills the essentials into one page. This executive overview should capture your quantified market opportunity (TAM, SAM, SOM with growth projections), highlight three to five key findings, and present a clear strategic recommendation—go, pivot, or pause—with the rationale behind it. Close with success criteria: the KPIs you’ll use to track progress, such as conversion rate, retention, or revenue per user.

What to include in your executive summary

Organize your executive summary using the following:

- Market opportunity and growth potential

- Key findings and insights that emerged

- Strategic recommendation with rationale

- Success criteria and KPIs

Build a clear strategic narrative

Turn your research findings into a story that connects directly to your product and growth plan. Define your competitive positioning—how your app stands out, where your strengths lie, and which market gaps you can fill.

Outline your user personas, linking each to a specific job-to-be-done. This ensures that product, design, and marketing decisions stay anchored to real user needs. Then, translate these insights into a feature roadmap: mark core features as must-haves for your MVP, postpone nice-to-haves for later, and list what to avoid based on user feedback.

Your monetization and go-to-market strategy should align with earlier research. Specify your chosen model (freemium, subscription, or hybrid), pricing tiers, and target conversion rates. Identify priority markets, keyword and ASO strategies, and the channels you’ll use to reach your audience. A short timeline of milestones—beta, soft launch, full rollout—helps visualize how these insights move into execution.

Set your decision framework

Every data-driven strategy needs clear thresholds for moving forward or pivoting. Establish go/no-go criteria that tie directly to your research metrics:

- Minimum market size: Define a realistic floor for market viability based on the share you can actually capture. For many early-stage apps, a serviceable obtainable market (SOM) above $1 million in annual potential revenue suggests a healthy opportunity—but this threshold will vary by category and resources.

- Competitive intensity: Prefer categories where fewer than five direct competitors have an App Power score above 70, signaling manageable competition.

- User willingness-to-pay threshold: Validate that a meaningful share of surveyed users, ideally 20–30 % expressing intent to pay for premium features—shows genuine pricing potential. Keep in mind that actual conversion rates are usually lower.

- Development feasibility and resource availability: Assess whether your current team, budget, and timeline can realistically deliver the MVP and first growth milestones.

Note that these are threshold examples. Calibrate them to your own app category, resources, and growth targets.

Assess risks and resource requirements

No plan is complete without understanding its risks. Evaluate:

- Technical risks such as platform constraints or integration complexity

- Market risks like new entrants or shifting user behavior

- Business risks related to monetization or rising acquisition costs

For each, outline mitigation tactics—additional testing, phased rollouts, or contingency budgets. Then detail your resource plan: development time, team size, budget allocation, and ongoing operational costs. Pairing risk and resourcing in one view gives leadership a full picture of investment versus exposure.

Turn research into execution

Finally, ensure your insights flow seamlessly into execution. Build a research-to-roadmap handoff that includes a prioritized backlog supported by user evidence, a KPI plan for tracking progress, and a test calendar for ongoing validation. Keep a decision log that documents assumptions, choices, and pivot conditions—this transparency keeps your team aligned even as the strategy evolves.

When done right, synthesis turns research into a living blueprint rather than a static report. It ensures that every insight drives a next step, every metric informs a decision, and your entire team moves forward with clarity and confidence.

Essential app market research tools

The right tools make research more efficient and accurate. Here’s a comprehensive toolkit for different research needs:

AppTweak: The all-in-one app market research platform

AppTweak combines App Store Optimization, competitive intelligence, ad intelligence, and market intelligence into one seamless platform. Powered by Atlas AI and backed by the largest app store dataset on the market, AppTweak helps you uncover insights faster, validate ideas earlier, and make smarter, data-driven decisions.

Here’s what makes AppTweak stand out:

- Market Intelligence: Analyze download and revenue trends across countries and categories to spot growth opportunities before your competitors. Benchmark performance by app, publisher, or category to identify emerging leaders and rising markets.

- AppDNA and GameDNA taxonomies: Go beyond the app stores’ generic classifications with AppTweak’s proprietary system—featuring 200+ app types and 70+ game genres—for precise competitive mapping and whitespace discovery.

- Atlas AI-powered keyword research: Gain semantic keyword insights with AI that understands context, intent, and relevance. AppTweak’s Chance Score and Relevancy Score make it easy to identify the keywords that truly move rankings.

- Competitive and creative intelligence: Track metadata updates, keyword shifts, screenshots, and A/B tests to decode your competitors’ strategies in real time.

- Custom reports and dashboards: Centralize your KPIs across ASO, paid campaigns, and app store performance with no-code, shareable dashboards that give teams one source of truth.

- Ad intelligence: Analyze competitor ad creatives and user acquisition strategies to understand where and how top publishers drive installs.

Together, these capabilities make AppTweak one of the most integrated platforms on the market—uniting ASO insights with market-level intelligence so you can see both the forest and the trees. From keyword validation to revenue forecasting and publisher benchmarking, AppTweak gives you a consolidated workspace for world-class app market research.

User research and survey tools

To complement your quantitative app intelligence, pair AppTweak data with qualitative insights from user research. Tools like SurveyMonkey, Typeform, and PickFu help you run surveys, concept tests, and quick preference studies to understand user motivations and validate hypotheses before launch.

App store analytics

Finally, don’t overlook your first-party app data. Platforms like App Store Connect and Google Play Console offer valuable context on downloads, retention, revenue, and crash performance. When combined with AppTweak’s external market intelligence, they provide a complete 360° view of both your own performance and your position in the wider market.

The role of AI in app market research

AI is transforming how app market research gets done. What once required teams of analysts: tracking competitors, parsing reviews, forecasting trends—can now be done in minutes. The impact isn’t just speed; it’s that AI adds pattern recognition and context that make insights easier to act on.

Automated competitive analysis

AI-powered platforms can continuously monitor competitors and alert you to significant changes in strategy, performance, or user feedback. This replaces manual tracking with automated insights.

For instance, AppTweak’s Atlas AI applies semantic understanding to group similar keywords, classify apps into nuanced AppDNA and GameDNA categories, and surface competitive insights that would normally take hours to uncover.

Review and feedback analysis

Machine learning algorithms can process thousands of app reviews to identify common themes, sentiment patterns, and feature requests. This reveals user needs at scale that would be impossible to analyze manually.

Advanced natural language processing can detect emerging issues before they become widespread problems, categorize feedback by topic, and track sentiment trends over time across multiple apps simultaneously.

Predictive market modeling

AI models can forecast market trends based on historical data, seasonal patterns, and external factors. This helps you time launches, plan feature releases, and allocate marketing budgets.

Predictive analytics can identify early signals in cohort behavior, flag churn predictors before retention drops become visible in aggregate metrics, and spot price sensitivity patterns across segments. Learn more about predictive analytics at AppTweak in our blog on Incrementality Analysis.

Personalized user research

AI-based clustering can uncover “micro-personas” built on behavior rather than demographics. That level of segmentation helps refine messaging and product design for distinct motivation groups—like users seeking focus vs. those chasing relaxation in a wellness app.

Governance and limitations

Maintain human-in-the-loop checks to avoid bias amplification and AI hallucinations, particularly when AI generates creative messaging or makes strategic recommendations. Always validate AI-generated insights against real user feedback and market data before making major decisions.

Common app market research mistakes to avoid

Learn from these frequent pitfalls to make your research more effective:

Mistake 1: Relying only on secondary research

Secondary data provides context but can’t answer app-specific questions. Industry reports tell you about broad trends but not whether your specific concept resonates with users or how your unique value proposition compares to alternatives.

Solution: Always supplement industry reports with primary research about your specific concept and target users through surveys, interviews, or prototype testing.

Mistake 2: Ignoring platform differences

iOS and Android users behave differently in terms of spending, app discovery, and feature preferences. iOS users typically spend 2-3x more on apps and in-app purchases, while Android users often prefer ad-supported free apps.

Solution: Research both platforms separately if you plan to launch on both. Your monetization strategy, feature priorities, and even design patterns may need to differ by platform.

Mistake 3: Overestimating market size

Be conservative with market sizing assumptions. Entrepreneurs often use top-down calculations that assume 5-10% market share, but new apps typically capture 0.1-1% of their addressable market in the first year.

Solution: Use bottom-up forecasting based on realistic conversion funnels. Model multiple scenarios and set go/no-go thresholds based on worst-case projections, not best-case dreams.

Mistake 4: Focusing only on features

Users care about outcomes, not features. Research showing users want “advanced analytics” doesn’t mean they’ll use complex dashboards—they want to understand their progress with minimal effort.

Solution: Research the jobs users are trying to accomplish and the problems they want solved, not just the features they think they want. Use jobs-to-be-done frameworks to uncover underlying motivations.

Mistake 5: Skipping monetization research

Assuming users will pay without validation is risky. Even successful apps often struggle with monetization because they didn’t test willingness to pay or optimize pricing until after launch.

Solution: Test pricing and monetization preferences early, even for free apps that plan to monetize later. Understanding what users value enough to pay for shapes product decisions from day one.

Mistake 6: Not updating research regularly

Markets evolve quickly in mobile. Competitive landscapes shift as new entrants launch, user preferences change with cultural trends, and platform policies alter what’s possible.

Solution: Refresh competitive analysis quarterly to track new entrants and strategy changes. Update user research annually or when entering new markets. Set up automated monitoring through tools like AppTweak to track keyword trends and competitor movements continuously.

Mistake 7: Ignoring failed competitors

Studying only successful apps creates survivorship bias. Failed apps often had valid concepts but poor execution, unrealistic expectations, or bad timing—lessons you can learn from.

Solution: Research apps that launched then shut down or apps with declining downloads. Analyze reviews to understand what frustrated users and why they abandoned the app.

Mistake 8: Asking users to predict behavior

Users are notoriously bad at predicting their own future behavior. Asking “Would you use this app?” typically generates 60-80% positive responses, but actual usage is often 10-20%.

Solution: Focus research on past behavior and current pain points rather than hypothetical future actions. Test with real prototypes that reveal actual behavior patterns instead of stated intentions.

Conclusion: Building a data-driven app strategy

App market research isn’t a one-off exercise; it’s an ongoing discipline that shapes smarter decisions throughout your app’s lifecycle. From early concept validation to post-launch optimization, consistent research reduces risk and helps you build products users genuinely value.

The best-performing app teams treat research as a competitive advantage. They stay close to user behavior, track market shifts continuously, and validate every assumption with data instead of instinct. This steady, evidence-based approach is what separates apps that grow sustainably from those that fade after launch.

Start with clear objectives that link each research step to a real decision. Understand your competitive landscape, validate demand, and size your market with realistic assumptions about reach and conversion. The goal isn’t perfect data—it’s confidence grounded in insight, not guesswork.

Good research pays off: it clarifies what to build, how to monetize, and where to compete. Keep your findings connected to roadmap priorities, marketing strategy, and measurable outcomes so insights turn into action.

Want to explore how market-level data can inform your next app strategy? Try AppTweak to analyze category trends, benchmark competitors, and uncover growth opportunities.

FAQs

Below we answer the most frequently asked questions about app market research.

What is app market research?

App market research is the systematic gathering and analysis of data about target markets, competitors, and users to inform mobile app development and marketing decisions.

How much does app market research cost?

Research costs range from $5,000-$50,000 depending on scope. Consider app market research tools like AppTweak for comprehensive app insights at competitive pricing.

What tools do I need for app market research?

Essential tools include competitive intelligence platforms like AppTweak, survey tools like SurveyMonkey, app store analytics from App Store Connect and Google Play Console, and user research platforms.

How do I size the market for my app?

Use the TAM/SAM/SOM framework: Total Addressable Market, Serviceable Addressable Market, and Serviceable Obtainable Market. Combine demographic data with category penetration rates and revenue estimates using AppTweak’s Market Intelligence.

Should I research competitors before building my app?

Yes, competitive analysis is crucial for understanding market dynamics, identifying differentiation opportunities, and learning from competitors’ successes and failures before investing in development.

How do I validate demand for my app idea?

Validate demand through keyword research showing search volume, competitor analysis of successful apps, user interviews confirming the problem exists, and prototype testing measuring actual engagement and willingness to pay.

What’s the difference between iOS and Android market research?

iOS and Android users differ in spending behavior, app discovery patterns, and feature preferences. iOS users typically spend more on apps, while Android dominates in emerging markets and requires different monetization approaches.

How often should I update my app market research?

Refresh competitive analysis quarterly to track new entrants and strategy shifts. Update user research annually or when entering new markets. Use automated monitoring tools to continuously track keyword trends and competitor movements.

I’m looking for free app market research tools?

With AppTweak’s Starter Plan, you can start your app market research for free. The Starter plan provides access to download and revenue estimates across apps and publishers, including past-month totals, for free.

Sukanya Sur

Sukanya Sur

Oriane Ineza

Oriane Ineza

Simon Thillay

Simon Thillay