The most downloaded AI apps in 2025

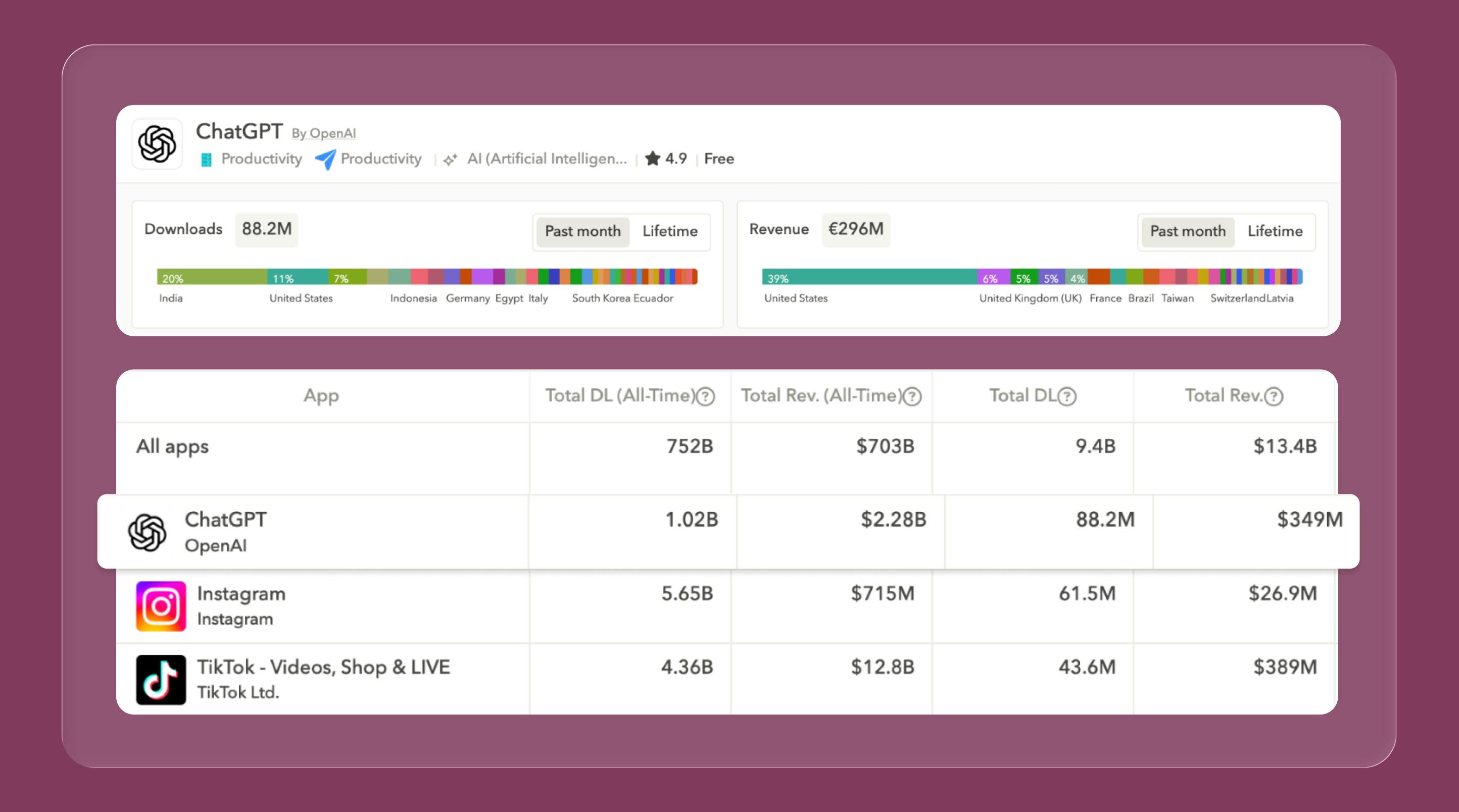

ChatGPT from OpenAI was the most downloaded AI app in 2025, securing 845.2M downloads according to AppTweak’s Market Intelligence data. This performance underscores the market’s consolidation around a few dominant players, with ChatGPT alone capturing a 31.7% share of downloads among the top 500 AI apps. This reflects a market where brand recognition and first-mover advantage have created a significant barrier to entry, even as new challengers emerge.

Between January 2025 and December 2025, the top 500 AI apps generated 2.7B downloads. While established leaders like ChatGPT and Google Gemini command the majority of the market, the data also reveals significant velocity from new entrants. For example, two apps launched in 2025, DeepSeek – AI Assistant and Grok • Smartest AI Advisor, quickly entered the top 10 rankings. This indicates that while the market is top-heavy, there is still room for disruptive products to rapidly acquire users.

Key takeaways

- Market concentration: The top two AI apps, ChatGPT and Google Gemini, represent a combined 43.1% of downloads among the top 500 AI apps. The top 10 apps account for 63.9% of total downloads in this category, indicating a market heavily dominated by a few key players.

- Rapid growth of new entrants: Two apps launched in 2025, DeepSeek – AI Assistant and Grok • Smartest AI Advisor, quickly secured top-10 positions with 110.5M and 87.7M downloads, respectively. This highlights the market’s dynamism and the potential for new apps to scale quickly.

- Publisher dominance: Publishers headquartered in the United States account for 6 of the top 10 most-downloaded AI apps. This geographic concentration suggests the US is the current epicenter for developing and launching high-volume AI applications.

- UX is shifting to “capture first”: A primary trend in 2025 is the move from text-only prompts to multimodal inputs. Leading AI apps are integrating voice, camera, and screen sharing directly into the chat flow, allowing users to “show” context rather than describe it.

- Monetization models are diversifying: Top AI apps are moving beyond simple subscriptions to hybrid models that include consumable credits and access to premium generation modes. These pricing tiers are increasingly integrated directly into the user interface, shaping how users interact with advanced features.

About the data set

This data was derived from AppTweak’s Market Intelligence. The dataset covers January 2025 to December 2025 and reflects worldwide performance across both the App Store & Google Play for the top 500 AI apps. The ranking is created by combining each app’s estimated downloads from the App Store and Google Play and ordering them from highest to lowest.

- Data source: AppTweak Market Intelligence

- Coverage: App Store and Google Play

- Metric: App downloads

- Time period: January 2025– December 2025

- Category: AI apps defined by AppTweak’s AppDNA taxonomy

- Geography: Global

- Last updated: January 2026

Category definitions:

- Productivity: Apps that make a specific process or task more organized or efficient, enable the user to solve a problem or complete a specific task, or assist the user in accessing, managing, or generating information.

- Entertainment: Apps that are interactive and designed to entertain and inform the user, and which contain audio, visual, or other content.

- Photo & Video: Apps that assist in capturing, editing, managing, storing, or sharing photos and videos.

Feel free to dig into your app category’s download and revenue estimates now in AppTweak’s Market Intelligence.

What are the top 10 most downloaded AI apps of 2025?

The ranking below highlights the dominance of large technology companies and the rapid emergence of specialized AI challengers. Here are the top 10 apps ordered by total downloads across the App Store and Google Play globally.

This table lists the top 10 AI apps apps ordered by total downloads, including app name, publisher, HQ, app downloads, and year-over-year growth.

| Rank | App Name | Publisher | Publisher HQ | Downloads | YoY Growth % |

|---|---|---|---|---|---|

| 1 | ChatGPT | OpenAI | United States | 845.2M | 156.8% |

| 2 | Google Gemini | United States | 305.2M | 113.0% | |

| 3 | DeepSeek – AI Assistant | DeepSeek | China | 110.5M | Infinity |

| 4 | Perplexity – Ask Anything | Perplexity AI, Inc. | United States | 89.1M | 483.0% |

| 5 | Grok • Smartest AI Advisor | xAI | United States | 87.7M | 594736.8% |

| 6 | Dola: Formerly Cici | SPRING (SG) PTE. LTD. | N/A | 75.7M | 135.9% |

| 7 | PolyBuzz: Chat with AI Friends | CLOUD WHALE INTERACTIVE TECHNOLOGY LLC. | United States | 50.2M | 31.6% |

| 8 | 豆包 | Beijing Chuntian Zhiyun Technology Co., Ltd. | N/A | 49.9M | 76.3% |

| 9 | Microsoft Copilot | Microsoft Corporation | United States | 48.3M | 3.9% |

| 10 | AI Chatbot – Nova | ScaleUp | Turkey | 44.8M | 12.0% |

Source: AppTweak Market Intelligence | App Store & Google Play | January 2025 – December 2025 | Global.

Notable apps at a glance

- ChatGPT – Rank #1, 845.2M downloads, Productivity

- Google Gemini – Rank #2, 305.2M downloads, Productivity

- DeepSeek – AI Assistant – Rank #3, 110.5M downloads, Productivity

- Grok • Smartest AI Advisor – Rank #5, 87.7M downloads, Productivity

- PolyBuzz: Chat with AI Friends – Rank #7, 50.2M downloads, Entertainment

3 key learnings from the top 10 AI apps

The data reveals clear patterns in how users are engaging with AI apps in 2025. These learnings summarize the strongest signals emerging from the top-ranking apps, according to AppTweak’s Market Intelligence dataset.

1. The market is consolidating around a few major players

The AI app landscape is heavily concentrated at the top. ChatGPT and Google Gemini together amassed over 1.1B downloads, accounting for a combined market share of 43.1% among the top 500 AI apps. The top 10 apps collectively captured 63.9% of all downloads in this cohort. This indicates that while the market is growing, user acquisition is disproportionately flowing to a small number of highly recognized brands, creating a significant competitive moat.

2. Newcomers can achieve massive scale with disruptive products

Despite the dominance of established players, the market remains highly dynamic. Two apps launched in 2025, DeepSeek – AI Assistant and Grok • Smartest AI Advisor, broke into the top five rankings within their first year. DeepSeek secured the #3 spot with 110.5M downloads, while Grok ranked #5 with 87.7M downloads. This rapid ascent demonstrates that there is still a strong appetite for innovative AI solutions, and new entrants can capture significant market share without a long-established brand presence.

3. Productivity is the dominant use case, but monetization strategies vary

Nine of the top 10 most-downloaded AI apps are categorized as Productivity on at least one app store, signaling that users primarily turn to these tools for task-oriented assistance. However, high download volumes do not always correlate with direct monetization. For instance, #3 ranked DeepSeek – AI Assistant reports a revenue per download (RPD) of $0, as does #6 ranked Dola: Formerly Cici. This contrasts with other apps in the dataset, like niji・journey – AI Anime Art ($28.0 RPD), suggesting that many top-funnel players are prioritizing user base growth over immediate revenue generation.

Key facts about the top 10 AI apps

- The top 10 AI apps account for 63.9% of the total downloads among the top 500 apps, highlighting a high degree of market concentration.

- Productivity is the most common category among the top 10, with nine of the ten most downloaded apps classified under it on at least one platform.

- Publishers headquartered in the United States are the primary drivers of the AI app market, accounting for six of the top 10 apps by downloads. This shows a strong geographic concentration in the development and scaling of leading AI applications.

- Several high-volume apps in the top 10 report $0 in revenue per download, including DeepSeek – AI Assistant (110.5M downloads) and Dola: Formerly Cici (75.7M downloads), indicating a focus on user acquisition over immediate monetization.

2025 Market trends for AI apps

The data reflects an app category in rapid transition, moving from simple text-based chatbots to integrated, multimodal assistants that are reshaping user expectations.

1. Multimodal “capture first” UX replaces the prompt-only chat box

The highest-velocity AI apps in 2025 increasingly treat the phone as a sensor, not just a keyboard. Voice is embedded directly in the same conversation thread as typing, and camera or screen sharing is positioned as a default way to ask for help. This shift changes user expectations, as people open these apps to “show” context—like a product or a homework problem—rather than spending time describing it precisely.

2. Social feeds and “remix” mechanics turn AI output into consumable content

A visible pattern in the most-downloaded creative AI apps is the move from “generate and save” toward “generate, scroll, remix, and share.” Short-form video feeds inside AI apps borrow the familiar interaction loop of mainstream social video, with prompts and remixes acting as the social object people pass around. As a result, discovery is more feed-driven, which lowers effort and increases repeat sessions.

3. “Task-first” design with templates and guided flows

Across assistants and creator tools, the user interface is becoming more structured. Apps increasingly open onto starter actions like “rewrite” or “summarize,” with presets and style selectors that convert vague intent into a reliable output. This design shift is especially apparent in high-download consumer creative utilities where the core loop is to pick a goal, choose a style, upload inputs, and review outputs.

4. Personalization becomes a productized feature

The most-downloaded conversational AI apps increasingly compete on continuity, with persistent threads, remembered preferences, and “choose your assistant” positioning. Instead of one neutral helper, apps offer selectable personas and conversation modes (coach, companion, tutor), making “how it talks” as central as “what it knows.” This changes user expectations around emotional tone and interaction quality.

5. Business models converge on hybrid monetization

A mainstream pattern in 2025 is monetization that mixes a base subscription with usage-based limits. Premium tiers unlock higher-quality generations and advanced features, while extra capacity is often sold as consumable credits. The practical consequence is that pricing is now part of the product design, with quality toggles and generation limits surfaced as first-class UI elements.

6. Trust and privacy positioning becomes a tangible differentiator

As AI apps move closer to personal data like screens, voice, and documents, more products are foregrounding privacy controls. This shows up as explicit data toggles, clear retention explanations, and privacy-forward branding. This trust layer increasingly determines whether users will engage with the most valuable features, such as camera input or personal document uploads.

Key facts about AI app market trends in 2025

- Leading AI apps are defaulting to voice, camera, and screen-based inputs within the same chat flow, reducing the need for users to craft perfect text prompts.

- Creative AI apps are adopting social media mechanics like feeds and remixing, turning AI-generated outputs into repeatable and shareable content formats.

- User experience is shifting from open-ended chat interfaces to task-packaged workflows with presets and templates that deliver reliable, specific outcomes.

- Monetization and trust controls, such as generation limits and privacy settings, are now surfaced directly in the everyday UI, shaping how people use advanced features.

Conclusion

The AI app market in 2025 is defined by a clear duopoly at the top, with ChatGPT and Google Gemini capturing a commanding 43.1% of downloads among the top 500 apps. The total market for these leading apps reached 2.7B downloads, demonstrating massive user demand. While the market is concentrated, it remains dynamic, with new challengers like DeepSeek – AI Assistant and Grok • Smartest AI Advisor rapidly scaling to top-10 positions within a year.

The dominance of the Productivity category and US-based publishers highlights the current centers of gravity for development and user adoption. Key trends shaping the future include the shift to multimodal inputs, the productization of personalization, and the convergence of hybrid monetization models. For marketers and developers, success will depend on navigating a landscape where brand recognition provides a strong advantage, but innovation in user experience and business models can still fuel explosive growth.

For deeper insights into these trends and to benchmark your own app’s performance, explore AppTweak’s Market Intelligence platform. You can start analyzing the data today with a Free Starter plan.

FAQs

Below we answer the top questions about the most downloaded AI apps.

Which AI app had the most downloads in 2025?

According to AppTweak’s Market Intelligence data, ChatGPT was the most downloaded AI app in 2025, recording 845.2M app downloads globally.

What was the total number of downloads for the top 500 AI apps in 2025?

The top 500 AI apps generated approximately 2.7B total app downloads between January 2025 and December 2025, based on data from AppTweak’s Market Intelligence.

What is the market share of the top 2 AI apps?

The top two AI apps, ChatGPT and Google Gemini, collectively accounted for 43.1% of all downloads among the top 500 AI apps in 2025.

Which category is most common for the top AI apps?

The most common category for top-performing AI apps is Productivity. Nine of the ten most-downloaded AI apps in 2025 are classified as Productivity on at least one app store.

How many of the top 10 AI apps were launched in 2025?

Two of the top 10 most-downloaded AI apps, DeepSeek – AI Assistant and Grok • Smartest AI Advisor, were launched in 2025, demonstrating the market’s high velocity.

Which country’s publishers dominate the top 10 AI apps?

Publishers headquartered in the United States dominate the top 10 rankings for AI apps, accounting for six of the ten most-downloaded apps in 2025.

What are the key product trends for AI apps in 2025?

Key product trends for AI apps in 2025 include the shift to multimodal inputs (voice and camera), the use of task-first designs with templates, and deeper product personalization with selectable AI personas.

Nathalie

Nathalie