Impact of Black Friday on Shopping Apps [2022]

As we enter the heart of the shopping season in 2022, Black Friday hit a record online spending despite inflationary pressures. Mobile app publishers leveraged this opportunity to attract new users, bring back old users, and increase sales hugely. Online purchases continued to gather huge momentum as consumers snagged great Black Friday deals and offers during the weekend.

Like last year, there were only a few changes in the top 10 apps ranking in the Shopping category during Black Friday in 2022. There were even fewer changes during November. The top 10 apps that ranked in the Shopping category on November 1st this year held onto their high rankings during Black Friday promotions on November 25th.

In this blog, we will review the impact of Black Friday on shopping apps in 2022.

Black Friday online shopping soars in 2022

In 2021, for the first time, Black Friday online shopping decreased – from 9 billion in 2020 to 8.9 billion in 2021. However, According to Adobe, Black Friday online spending hit a record high in 2022 as consumers spent 9.12 billion dollars, which is a 2.13% increase from last year. Electronics were a big contributor with online sales increasing 221% over an average day in October. Toys and exercise equipment were other popular categories for shoppers during Black Friday 2022.

With consumers dealing with inflation and high prices, buy now, pay later (which allows users to make purchases and pay for them at a later date, interest-free) saw a huge increase during the week of Black Friday. Starting on November 19th, buy now, pay later apps saw payments increase by 78% compared to the previous week.

Mobile phone purchases also set a record. Online sales from smartphones made up 48% of all online orders, an increase from 44% last year. With a record-breaking amount of purchases being made from smartphones, it’s more important than ever to optimize your app’s metadata and creatives for seasonality to take advantage of this surge!

Impact of Black Friday on App Store downloads & performance

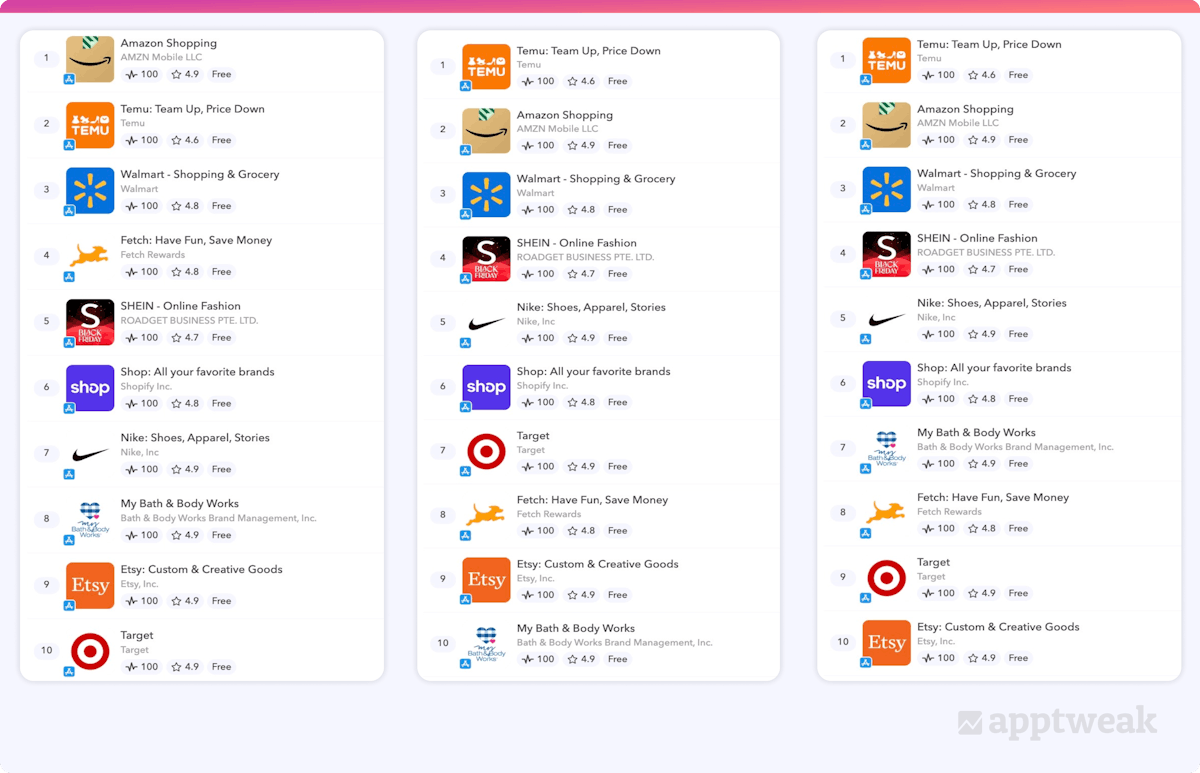

To help you better understand the impact of Black Friday on shopping apps in 2022, we have analyzed how download estimates fluctuated for different apps during the event. In the following chart, we see the top 10 rankings for apps in the Shopping category (US App Store) on different dates, November – 1st, 15th, and 25th. The rankings remained stable with only minor changes.

Category rankings in the Shopping category on 1st, 15th, and November 25th (Black Friday) respectively in the US, App Store.

Category rankings in the Shopping category on 1st, 15th, and November 25th (Black Friday) respectively in the US, App Store.

Now let’s take a look at some of the apps ranking in the top 10 in the Shopping category to understand how they benefited or did not benefit from Black Friday 2022 on the App Store.

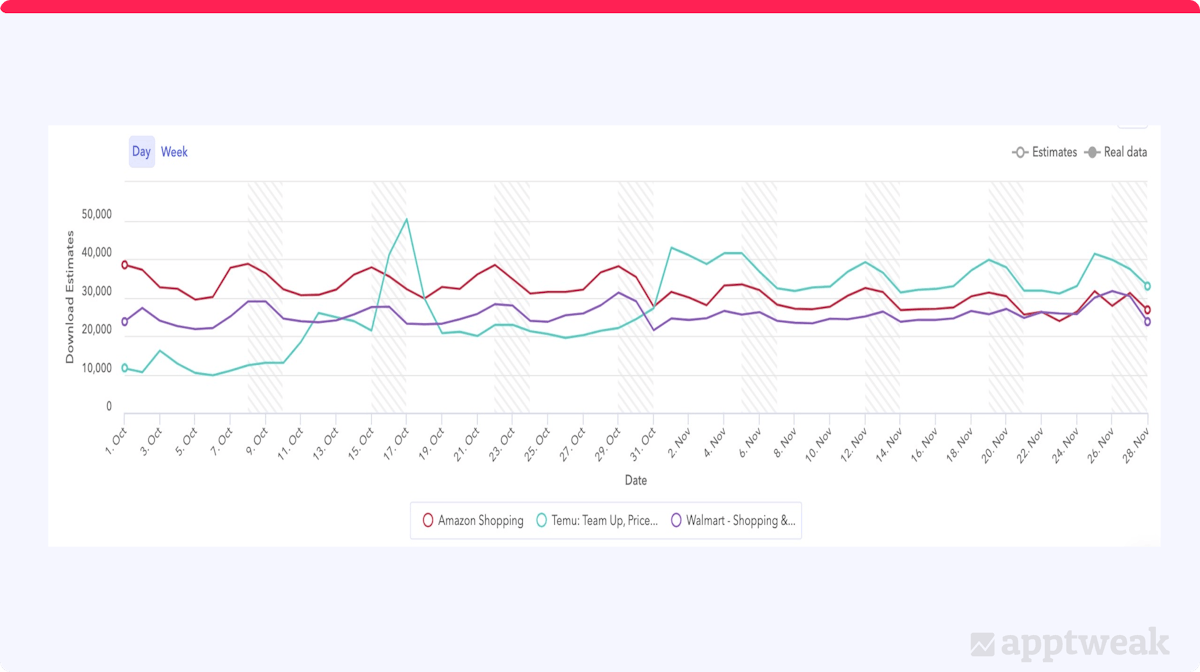

1. Amazon Shopping, Temu: Team Up, Price Down, & Walmart

Download estimates in October and November for Amazon Shopping (red), Temu (green), and Walmart (purple).

Amazon consistently ranked #1 in the Shopping category for October but was overtaken by Temu on November 2nd. This correlates with a similar trend for daily download estimates, where Amazon consistently received more estimated daily downloads than Temu for October but Temu received more daily downloads than Amazon for November. Walmart started to receive more estimated daily downloads than Amazon for a couple of days near the end of the month.

While there most certainly are other external factors contributing to this, the lack of Black Friday-focused metadata and creative updates by Amazon may also be a reason behind losing its rank to Temu. Both Temu and Walmart updated their app descriptions and screenshots to highlight Black Friday promotions, while Temu also ran an in-app event.

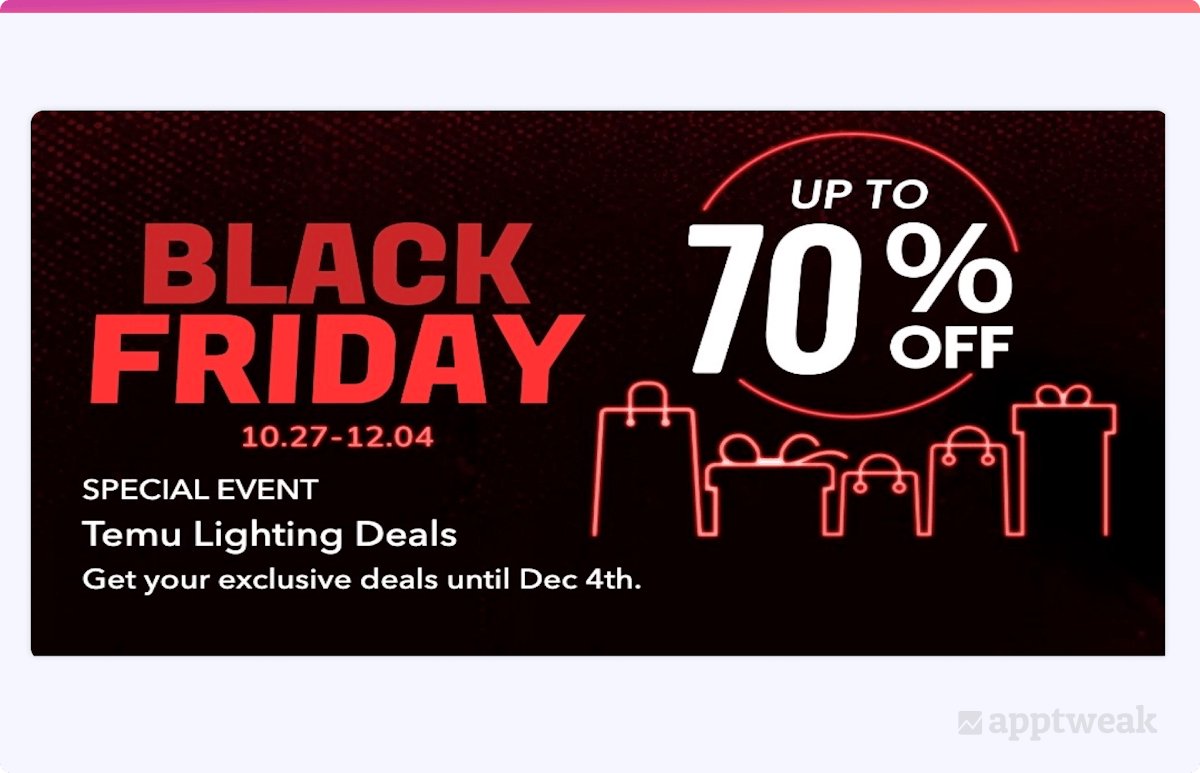

Black Friday in-app event run by Temu.

Black Friday in-app event run by Temu.

Compared to October, Amazon received 4,800 fewer daily downloads in November, while Temu and Walmart received 15,300 and 300 more daily downloads respectively.

While the increase in downloads for Temu and Walmart cannot be solely attributed to their black Friday metadata and creative updates, it makes sense to incorporate “Black Friday” and seasonality into your ASO strategy to rank high in the stores.

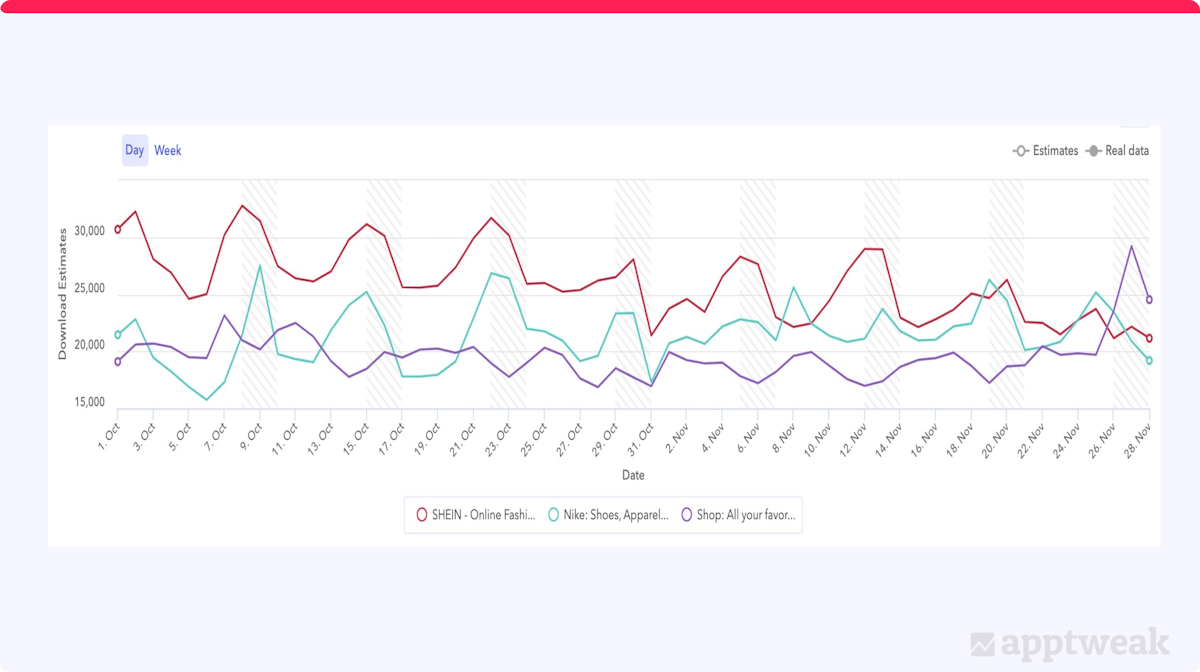

2. SHEIN, Nike, & Shop

Download estimates in October and November for SHEIN (red), Nike (green), and Shop (purple).

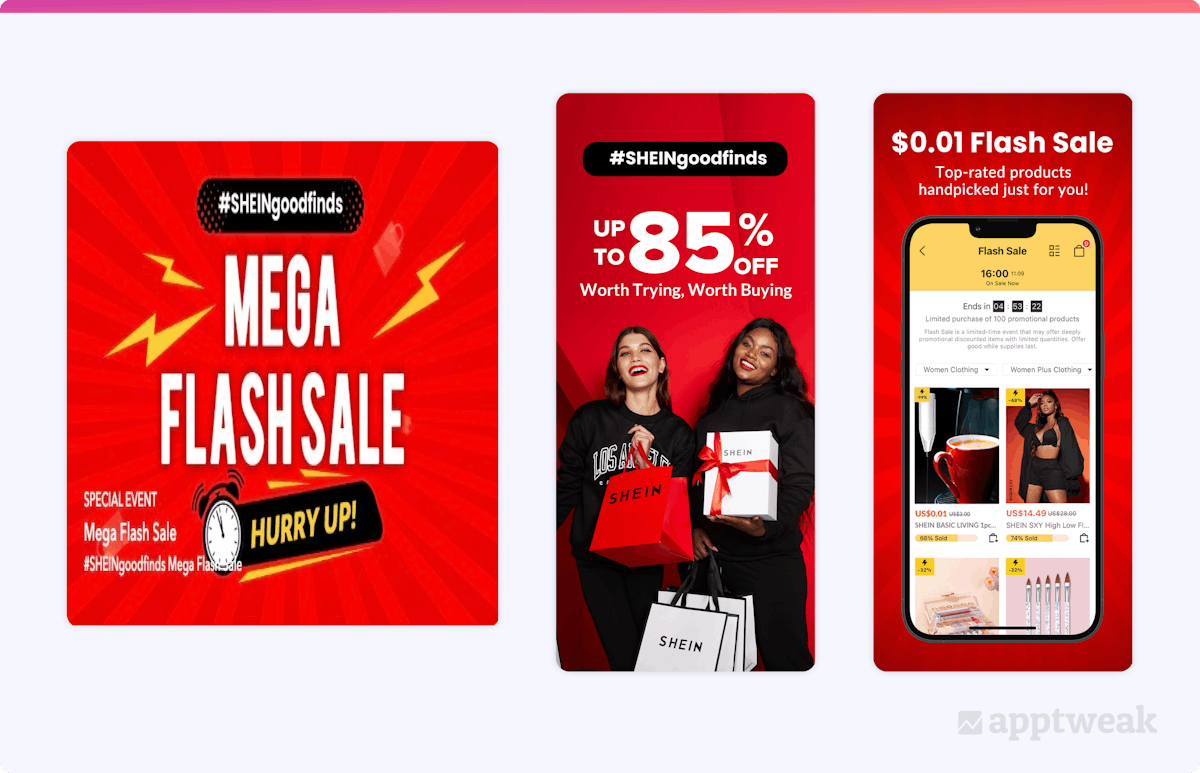

Out of the 3 apps, SHEIN was the only app to make a specific change dedicated to Black Friday. The app updated their icon to adjust the color scheme and incorporated “Black Friday” below the logo. SHEIN also changed their screenshots and ran an in-app event in November, but these two elements highlighted a “mega flash sale” and didn’t specifically mention “black friday.”

SHEIN flash sale in-app event and screenshots for Black Friday.

SHEIN flash sale in-app event and screenshots for Black Friday.

Nike did run a few in-app events in November, but they were not sales- or Black Friday-focused. The app did update their description to highlight end-of-the-year sales and incorporated “gifts for every athlete” in the first screenshot. Still, Nike did not mention the keyword “Black Friday” in their app creatives or visible metadata.

Shop ran an in-app event to highlight a sale, but that wasn’t Black Friday-focused either. Also, the event only ran for a few days. Shop also updated their icon and screenshots in November, but they were design changes and did not have anything to do with sales or Black Friday.

Overall, there was a minimal impact on each app’s performance during Black Friday. Nike increased its category rank from #7 at the beginning of November to #5 on Black Friday, SHEIN climbed up from #5 to #4, while Shop continued to rank #6 in the charts.

The estimated daily downloads for these 3 shopping apps remained pretty stable between October and November. SHEIN’s estimated downloads decreased by 3.7k, Nike’s daily downloads increased by 1.1k, and Shop’s daily downloads remained the same.

3. Best Buy, Target, & Etsy

Download estimates in October and November for Best Buy (red), Target (green), and Etsy (purple).

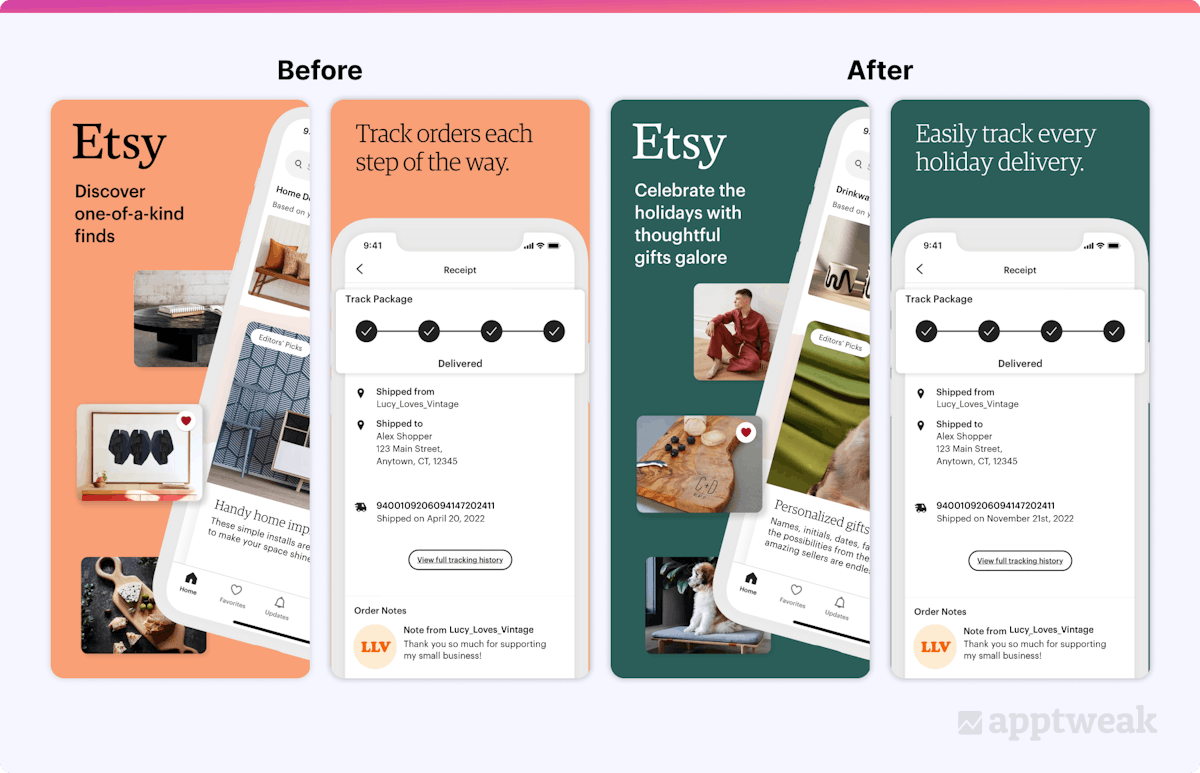

Etsy was the only app to make any changes in general to their app creatives, while none of the apps made any visible metadata changes.

Etsy updated the color scheme of their screenshots to green and white to make them look a little more festive. They also highlighted their holiday shopping features in screenshots 1 and 3.

Etsy’s before and after holiday screenshots.

Etsy’s before and after holiday screenshots.

Among these 3 apps, Black Friday had the biggest impact on Best Buy and Target. Best Buy increased its category ranking from #30 at the beginning of November to #11 on November 25th, Black Friday. Best Buy also saw the biggest increase in daily downloads from October to November. Target’s category ranking increased from #10 at the beginning of the month to #9 on Black Friday, but ranked as high as #7 in November and saw the second biggest increase in daily downloads. Etsy’s category ranking and daily downloads remained stable.

Even though Best Buy and Target didn’t make any visible metadata or creative changes during November, it does make sense that Black Friday had the biggest impact on them. Electronics, toys, and exercise equipment were the 3 biggest categories for shoppers during Black Friday this year. Both Best Buy and Target sell products in all 3 of those categories, so most likely the increase in downloads and category rankings came from branded searches.

Use ASO to increase your app’s visibility for Black Friday

According to Adobe, this year set a record for the number online of sales made from smartphones (48%), a trend that could very likely continue. With more and more purchases being made from smartphones, it makes sense to incorporate seasonality into your ASO strategy.

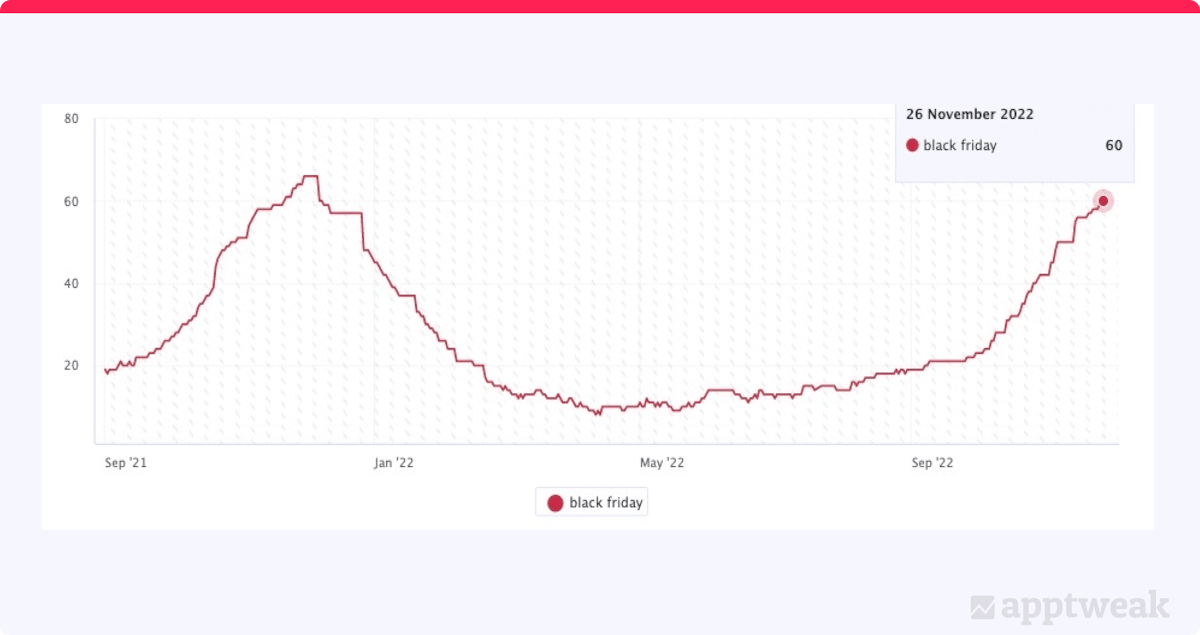

“Black Friday” volume seasonality trends for 2021 and 2022 (US, App Store).

“Black Friday” volume seasonality trends for 2021 and 2022 (US, App Store).

The graph (above) highlights the volume seasonality trend of the keyword “black friday” for 2021 and 2022. The volume starts to rise in September before peaking at the end of November. The search volume for “black friday” tripled between September and November, both in 2021 and 2022. Therefore, incorporating an effective ASO strategy to take advantage of these trends is crucial if you think your app will be impacted by Black Friday. Remember, you win the seasonality battle early!

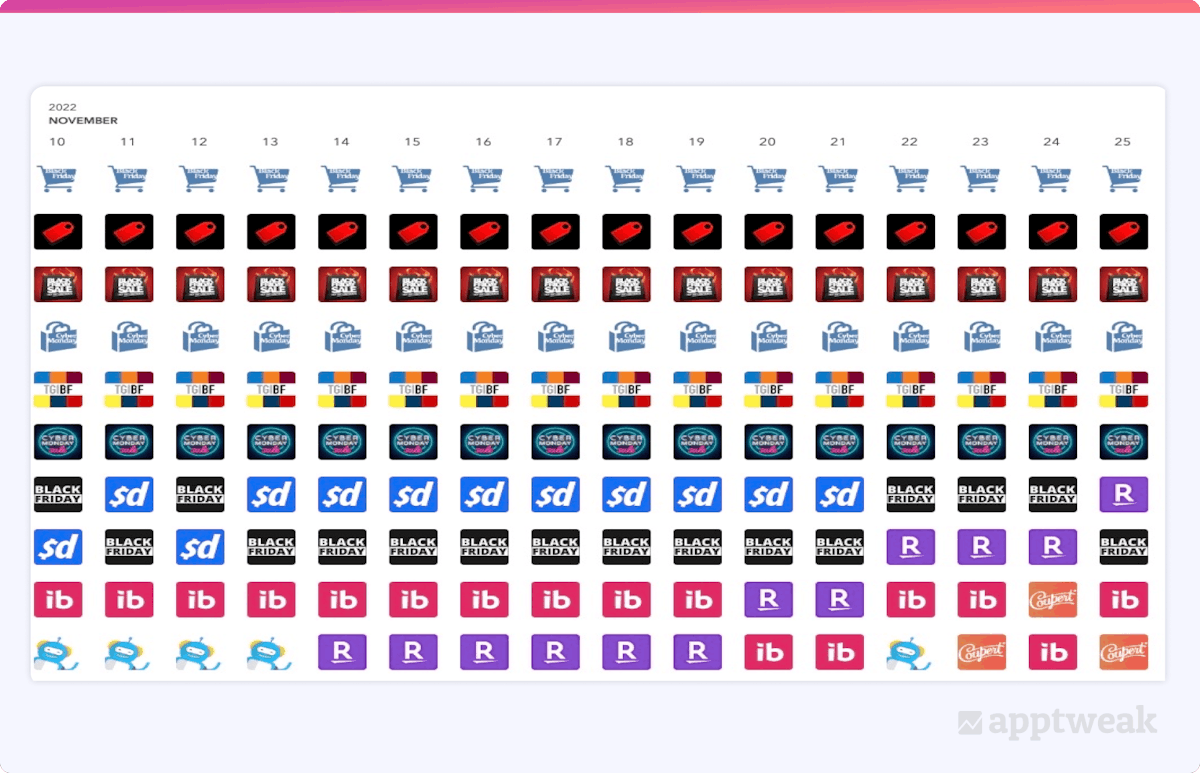

Keyword ranking history for “black friday” (US, App Store).

Keyword ranking history for “black friday” (US, App Store).

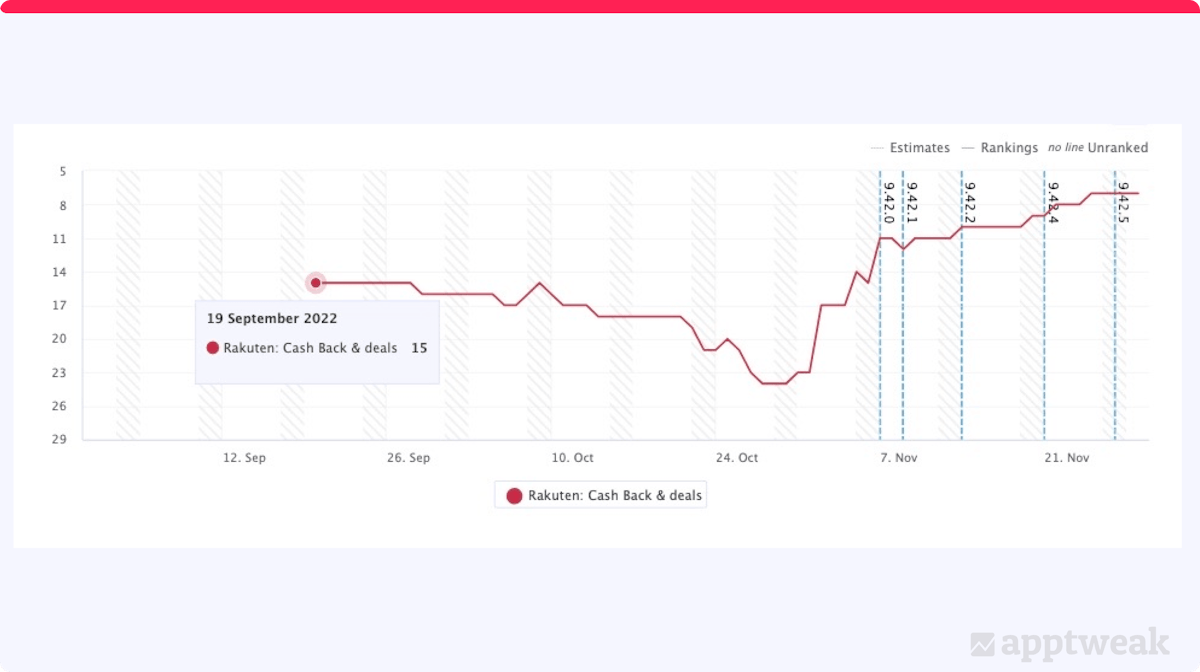

Rakuten increased its ranking for “black friday” from #23 at the end of October to #7 on Black Friday. The app updated their promotional text, description, and screenshots in November to highlight Black Friday promotions, which would have a direct impact on its conversion rate. Rakuten did not make any updates to the app’s title and subtitle, which have a direct impact on the app’s visibility. They most likely added “black friday” to the keyword field sometime in September, as they did not rank for the keyword until after September 19th.

Rakuten’s keyword ranking history for “black friday” in 2022 (US, App Store).

Need some tips on how to conduct your keyword research? Check out this blog!

Rakuten adopted a great strategy here. They most likely updated the keyword field in September to target the keyword “black friday” just as the volume started to pick up for this search term. This signaled early to Apple’s algorithm that Rakuten is relevant for this keyword. With the spike in search volume, the app’s visibility increased as well. At the beginning of November, just as the search volume for “black friday” hit the peak, Rakuten started updating their promotional text, screenshots, and description to help convert users from the increased visibility.

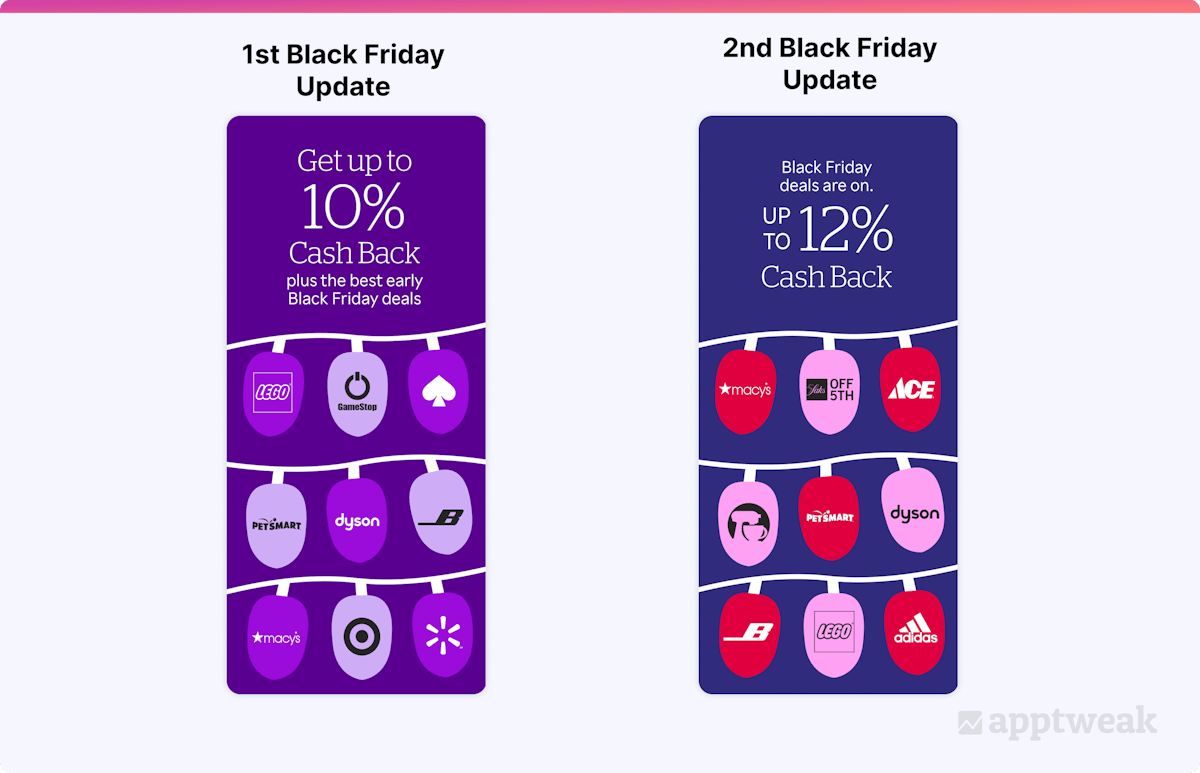

Rakuten’s Black Friday screenshots (US, App Store).

Rakuten’s Black Friday screenshots (US, App Store).

Rakuten also updated their screenshots twice in November to highlight different Black Friday promotions. The first change highlights its early Black Friday deals and the 10% cash back users can take advantage of. Three days before Black Friday, they highlighted that their “Black Friday deals are on” and bumped up the cash back to 12%. They also did a good job of highlighting brands in different categories, such as toys and electronics (2 of the 3 biggest categories this year), to ensure that they are appealing to as many users as possible.

Rakuten is a perfect example of the great results you can potentially achieve with a seasonal ASO strategy!

Conclusion

Even with inflation and high prices, consumers spent a record $9.12 billion during Black Friday in 2022. Mobile orders also hit a record as 48% of online sales were made on smartphones. It will be interesting to see if this trend continues. But it is not too late to incorporate seasonality into your ASO strategy for December, which is always a huge month for shopping!

Want to check out AppTweak’s ASO tool for yourself? Sign up for a 7-day free trial to view top category rankings, download and revenue estimates, and even changes in keyword rankings!

Sukanya Sur

Sukanya Sur

Oriane Ineza

Oriane Ineza

Micah Motta

Micah Motta