Brand vs. Generic Keyword Optimization for App Store Search

Analyzing the breakdown of generic vs. brand keywords is important when optimizing your app’s metadata. Generic keywords are those which are not identified as being attributed to a specific brand. For example, a brand’s name is a brand keyword, but the products the brand offers within its app are almost always going to be generic keywords.

When doing ASO work, it is crucial to use both brand and generic keywords in order to optimize an app to the best of your ability. In this blog, we break down the importance of both types of keywords and highlight how AppTweak can help you discover which generic keywords are ideal for your app to target.

What are brand keywords?

Brand keywords are directly associated with a specific brand or product, such as “Instagram,” “YouTube,” or “Facebook.” These terms are highly targeted and usually entered by users who know exactly which app they want. For instance, instead of searching for “social media app,” a user might type “Instagram” into the search bar.

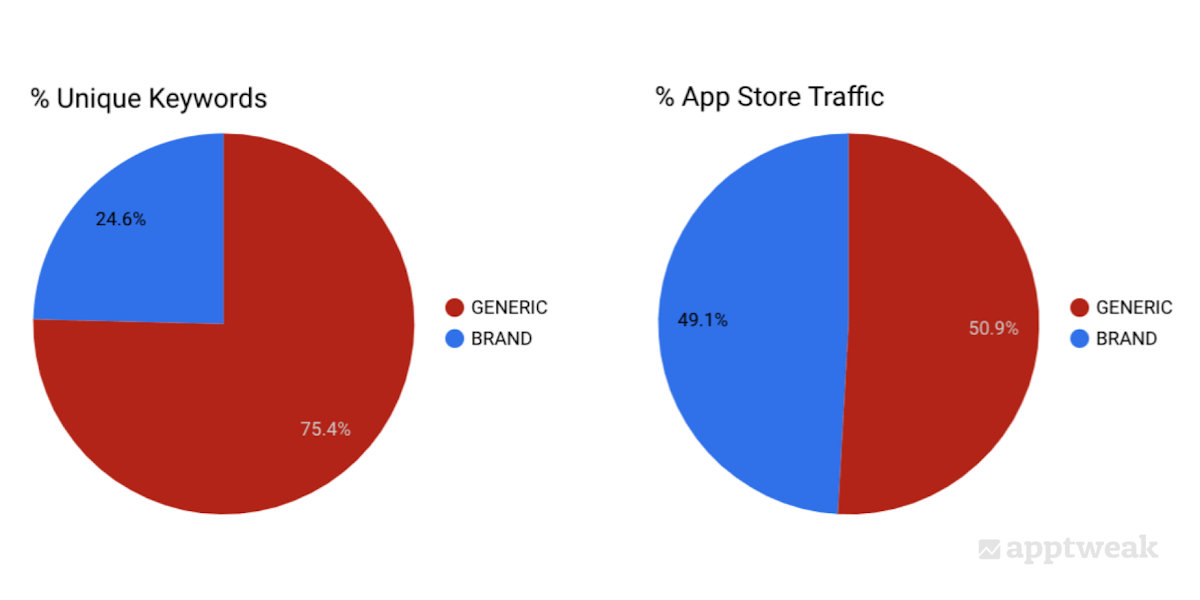

Brand keywords drive 49% of App Store traffic

We wanted to know how frequently users searched for brands vs. generic keywords on the App Store. To do so, we had a look at all keywords that have a Search Popularity score above 12 and separated the brands from the non-brands. We then estimated the number of daily searches a keyword drives based on Apple’s Search Popularity score and our aggregated app data. We found that, although brands only account for 24% of all keywords (as in 2019), branded keywords currently drive 49% of all App Store traffic – a 14% increase since 2019.

Comparing the percentage of unique keywords with a Search Popularity above 12 against the traffic they drive on the US App Store.

It’s interesting to note that search from generic keywords still accounts for more than half of App Store traffic, although we tend to think that users mostly look for brands in the store.

Read this blog to learn all about keyword optimization for the app title

What are generic keywords?

Generic keywords, on the other hand, are broader, non-branded terms that describe the app’s function or purpose. Examples include “photo editing app,” “fitness tracker,” or “racing game.” These keywords are typically used by users who do not have a specific app in mind but are searching based on a need or interest.

Brand keywords have higher search volumes than generic ones

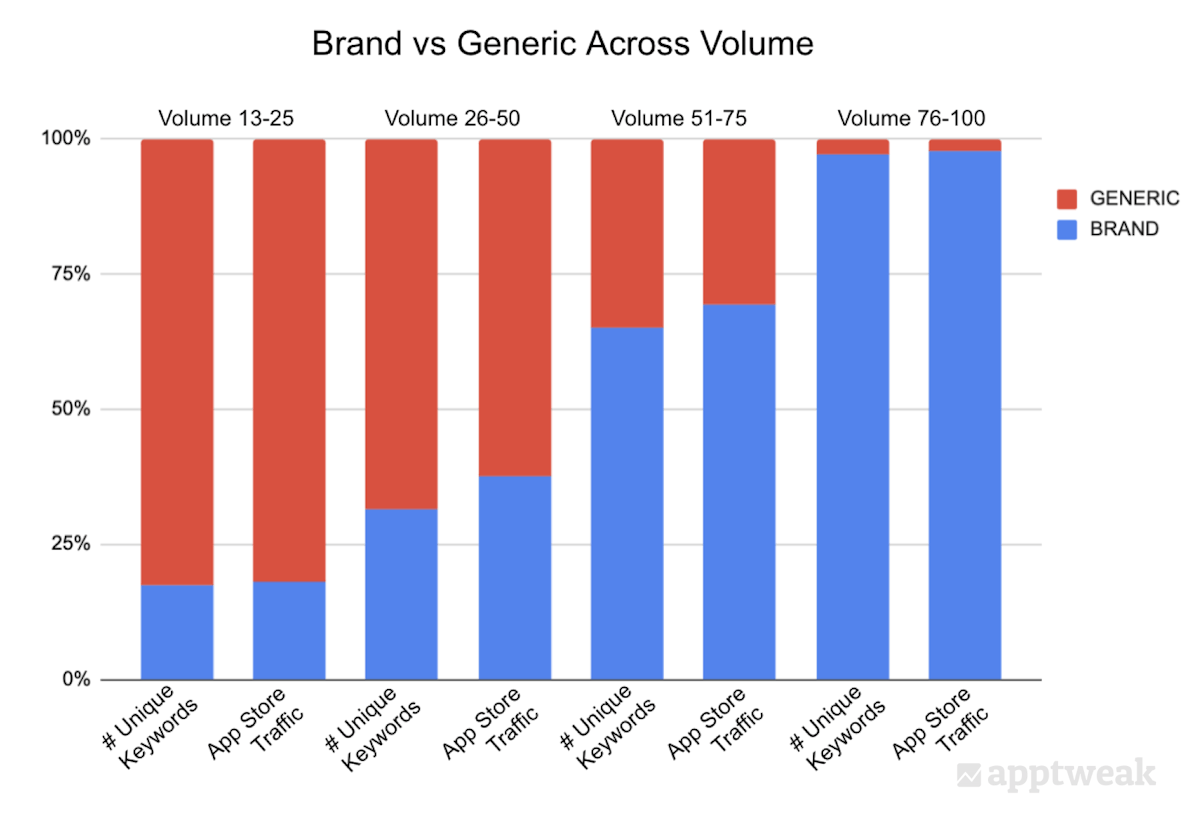

In the graph below, we show how the distribution of brand vs. generic keywords changes across different levels of search volume. The proportion of branded keywords increases significantly as we look at keywords with higher volumes. This explains how 24% of keywords end up driving 49% of App Store traffic – these keywords represent a high concentration of the App Store’s high-volume search terms.

Distribution of brand vs. generic keywords and the traffic they drive for a group of keywords with given volumes (US App Store).

Among all App Store keywords with a volume above 75, more than 97% are brands. This percentage drops down to 18% for keywords that have a volume below 25.

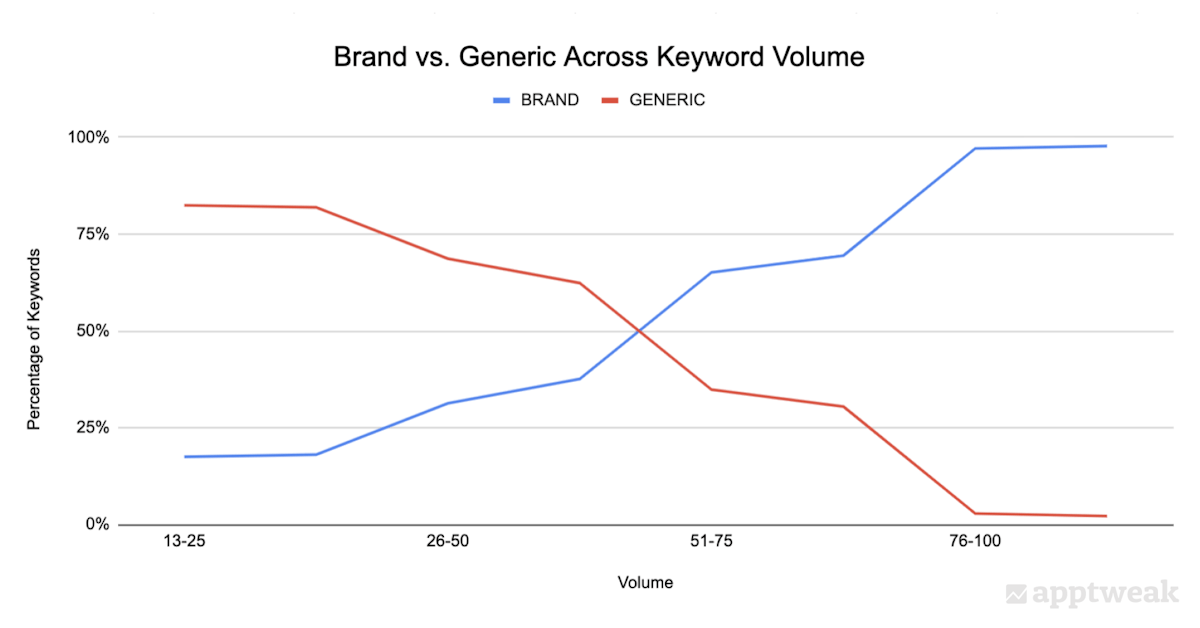

If we look at the full spectrum of generic vs. brand distribution across volumes, we also note that all keywords with search volumes above 90 are exclusively brands!

The percentage of keywords that are brands vs. generic across keyword volumes (Apple Search Ads Popularity score).

Learn more about our brand algorithm

When to use brand keywords?

- Established apps: If your app already has a strong brand presence, most of your search traffic will likely come from brand keywords. For example, users searching for “Spotify” are already familiar with the app and are more likely to convert.

- Defensive strategy: For established brands, brand keywords serve as a defense mechanism. It ensures that competitors don’t capitalize on your name by bidding on it in search ads. Many brands run paid search campaigns using their brand keywords to block competitors.

When to use generic keywords?

- New or lesser-known apps: If your app is new or has not yet established a strong brand, generic keywords are essential to gain visibility. Users looking for solutions like “best language learning app” or “outdoor activity tracker” are potential customers who could discover your app through these broader search terms.

- Long-tail strategy: Generic keywords help you capture long-tail search traffic. These are less competitive, low-volume keywords that, when combined, can drive significant traffic to your app. Even if your app has a strong brand, optimizing for generic keywords ensures you reach new, untapped audiences.

Leverage keyword optimization

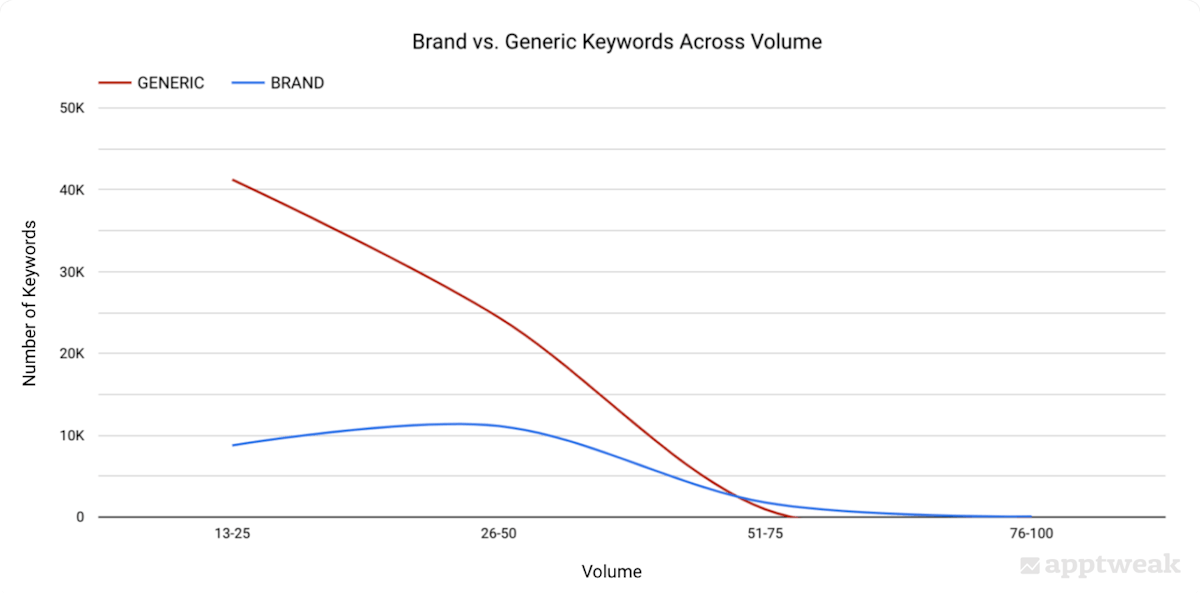

That said, we have to keep in mind that our analysis considers 3 times more generic keywords than branded keywords.

When it comes to App Store traffic, although high-volume keywords are mostly brands, there are many low-volume keywords, which, when strategically combined, represent a big portion of App Store traffic.

Proportion of unique brand vs. generic keywords across volumes on the US App Store.

In other words, generic keywords constitute a very long tail of App Store traffic. This is where you can make a difference – capturing the traffic from those generic keywords can really help to increase the overall downloads to your app.

There are several ways in which you can optimize your app’s metadata by using generic keywords:

- To start, you can use AppTweak to discover the generic keywords driving installs for your competitors, and then target those keywords within your own app’s metadata.

- We recommend that most (or all) of the keywords targeted in your iOS keyword field be generic. Repeating keywords in your App Store metadata will not help to increase your app’s visibility for those keywords. Since your brand name will most likely already be in the title, there is no reason to target it again in the subtitle or keyword field.

Expert Tip

In theory, Apple forbids app marketers from adding competitor brands to their app store listings. Even if your app manages to organically rank in a good position for a competitor term, conversion rates tend to be much lower since the user already has a particular app in mind. We estimate that the conversion rate of an app on its own brand is around 85%, but this falls to around 25% for the first app in a generic keyword search.Use generic keywords even if you have a strong brand

If your app already has a strong brand, most of your downloads are most likely driven by your brand keywords. However, this should not influence you to only continue targeting these brand keywords in your metadata.

Generic keywords are highly useful to gain new customers. If you have an outdoor clothing app with a highly developed brand, many people are probably searching for your app by its brand name – but what about users who are not loyal to your brand yet?

For example, a member of your target market may be searching for an “outdoor clothing app” or “high quality hiking gear.” If your competitors are targeting the keywords “outdoor,” “hiking,” and “clothing” in their metadata and you are not, these competitors will most likely rank higher for such keywords and gain this user’s download. By not working on your generic keyword optimization, you are missing an opportunity to convert even more store visitors than you are now.

Discover how to choose the best keywords for your app on the App Store and Google Play

Optimizing for both brand & generic keywords

To create an effective ASO strategy, it’s important to leverage both brand and generic keywords.

- Brand keywords: These should appear in your app’s title and metadata, especially if your app already has a strong reputation. For instance, if your app is a well-known game, include the brand name in the app title and subtitle.

- Generic keywords: Use these in your keyword list or other metadata fields. Aim for high-performing, relevant terms that describe your app’s features or category, such as “language learning” or “fitness tracker.” This helps you capture broader searches and reach potential users who may not know your brand.

TL;DR

Making your app visible for relevant generic keywords can increase your app installs and capture part of the long-tail traffic they generate. This is where ASO tools like AppTweak can help you identify the best keywords for your app and monitor its performance over time.

Based on our actionable ASO KPIs, adapt your app listing to fully optimize it and leverage the potential of generic keywords.

- Although brands only account for 24% of all keywords, branded keywords currently drive 49% of all App Store traffic.

- Among all App Store keywords with a volume above 75, more than 97% are brands. This percentage drops down to 18% for keywords with a volume below 25.

- You can use AppTweak to discover the generic keywords driving installs for your competitors – then target those keywords in your own metadata.

- Making your app visible for relevant generic keywords can increase your app installs and capture part of the long-tail traffic they generate.

How does your app perform on branded vs. generic keywords? Discover how to optimize your metadata fields with AppTweak.

Micah Motta

Micah Motta

Justin Duckers

Justin Duckers

Lina Danilchik

Lina Danilchik