App Store Optimisation trends to watch out for in 2026

With the beginning of a new year comes the traditional moment when I get to look back at the major changes of the last 12 months in ASO and reflect on which trends will be most important to keep in mind for the year ahead.

2025 was referred to as “the year of AI” at multiple conferences I attended, yet the impact of artificial intelligence on App Store Optimisation specifically has been more difficult to measure than in other niches of the app industry: user-facing AI features such as user review summaries and app tags (iOS) have felt somewhat underwhelming. And although Apple and Google introduced significant changes to search results in English-speaking stores, they have not openly communicated as to the exact logic powering these changes.

Meanwhile, adapting the user experience to context continued to fuel multiple store changes and experimentations, from more custom pages capabilities to game-specific store experiences. At the same time, regulation changes opened the way to more web-to-app (and app-to-web) funnels, and pressure continued to mount regarding the value and efficiency of paid store advertising.

As 2026 begins, all these trends look poised to influence the next 12 months for app marketing. So what should we look out for more specifically?

Key takeaways

- AI’s impact on ASO in 2025 was limited at the feature level but more visible in how app store search interprets user intent.

- App discovery is increasingly fragmented across platforms, while app stores remain the main place where installs are decided.

- Semantic matching and intent signals are becoming more important than exact keyword matching alone.

- Custom pages and tailored store experiences continue to gain importance, though scalability and measurement remain challenges.

- Store featurings, app and game separation, and alternative payment options are all set to possibly reshape visibility and monetization strategies in 2026.

Can app stores remain the default platform for app discoverability in the AI era?

App stores AI features have yet to make their mark

Even as AI-driven interfaces reshape how users articulate intent, app stores continue to sit at the center of how that intent is ultimately converted into downloads.

When it comes to AI features in the App Store and Google Play, 2025 brought multiple signals of changes starting to happen “behind the scenes”, however consumer-facing AI features have been somewhat of a letdown, at least when compared to other industries that adopted it much faster. AI-written summaries of user reviews have not (yet) changed how users decide to download an app or not, while tags can hardly be correlated to any trend in how browse traffic flows towards certain apps more than others.

A shift toward intent-driven app store search

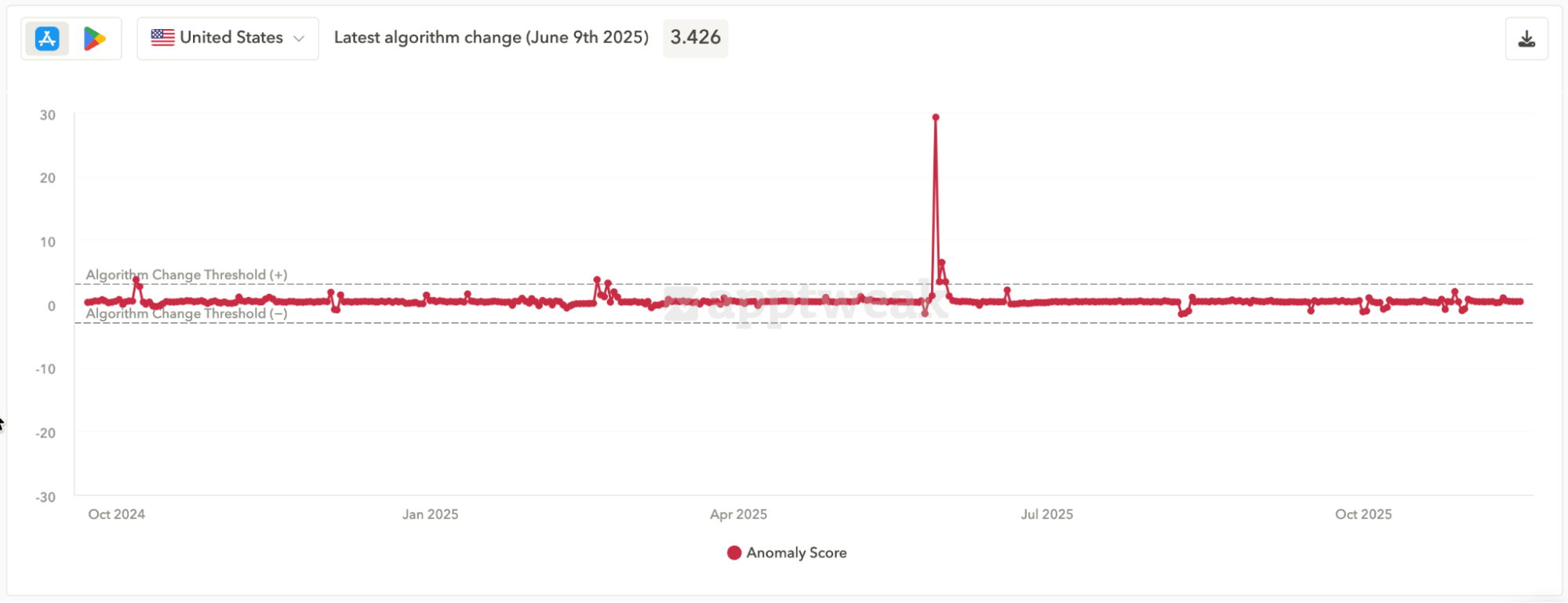

In fact, the most significant change AppTweak observed in the App Store was a search algorithm update released in early June, which led to the highest anomaly scores we’ve ever detected in the U.S. when monitoring keyword search results. Apple did not announce or otherwise communicate about the change, but our own observations suggested App Store search results are now determined in such a way that top results should show more search intent diversity when applicable, instead of keeping the first ten to fifteen results focused on a single intent type.

As for Google Play, the introduction of Guided Search in the U.S. in September 2025 started presenting users with more specific search result previews when Google identifies the initial query can match more than one intent, but does not go beyond the “try this query instead” logic so far.

The growing fragmentation of app discovery

In this context, marketers are starting to question whether consumers will continue to rely on app stores to discover new apps in 2026 and beyond, or instead turn to AI answer engines (or even other sources) to help them specify their needs and intent, making app stores less about initial discovery alone and more about intent fulfillment—where relevance, trust signals, and conversion optimization become decisive.

2026 is therefore set to be a pivotal year during which marketers will need to:

- Identify changes in user acquisition journeys and link them to specific platform efforts:

- ChatGPT and other AI assistants may start emerging as consistent traffic sources leading to app store pages or app download pages on the web.

- Apple and Google may look to build chatbot experiences inside their respective app stores to help users discover apps in an interactive manner. (Note: as of January 2026, Google Play Store v49.3 does include an “Ask Play experience […] that lets you talk to the Play Store like a personal assistant.”, however, it is not yet clear whether the feature appears only for installed apps or also for new apps to discover).

2. Investigate what are the key relevance factors to influence app-specific GEO and increase (qualified) discoverability for their app

- App store search results changes in 2025 appeared to have initiated a search from exact keyword matching to semantic keyword matching …

- … however more conversational experiences may need to rely more on user reviews (whether pulled directly from the stores or third party sources) and official developer FAQs to generate accurate answers.

In this context, a particularly interesting sub-question will also be whether OpenAI might decide to create an app store of its own. While their App SDK allows developers to offer agentic actions in their respective apps to ChatGPT’s broad user base, OpenAI has in fact, not (yet) released any app store to let developers distribute their apps on a new platform.

So far, OpenAI’s actions suggest more interest towards building an LLM-powered operating system than going after third-party software distribution; however, such change would not be impossible for 2026 when you consider OpenAI may look for new ways to create revenue streams, and history shows the App Store was introduced less than a year after the first iPhone release with 500 applications available when it was introduced.

How will app stores further customize consumer experiences in 2026?

As Apple and Google continue to experiment with how apps are presented to users, customization remains a central—and still evolving—pillar of their app store strategies.

What is coming next for custom pages?

In 2025, both Apple and Google expanded the capabilities of custom product pages and custom store listings, signaling that they are a major component of their respective vision for app store marketing. Apple doubled the maximum amount of custom product pages developers can release and introduced custom product page delivery to organic search results, while Google introduced an asset library function to help developers better navigate the creation and management of custom store listing assets.

However, two areas that have yet to be addressed by Apple or Google in their efforts to increase developer adoption of custom pages are helping app marketers identify new opportunities to serve custom pages, and making them easier to serve to audiences that keep evolving.

In this regard, Apple or Google could explore offering automated, dynamic serving of custom pages based on algorithmic matching or AI-powered intent detection, somewhat similarly to how certain ad platforms match users and creatives on behalf of advertisers. Nevertheless, neither Google nor Apple have indicated their intent to pursue such efforts so far, and the need for deeper custom pages analytics to help prove their value to developers might impact how Apple and Google will prioritize these efforts in future store versions.

How will store featurings evolve to better match increasingly customised store experiences?

Ever since Apple and Google rolled out In-App Events and Promotional Content, developers looking to get their apps featured in stores have looked for ways to produce content to maintain and increase their store visibility outside of search. Over time, this has skewed featurings by Apple and Google towards more content-first apps than functional apps, while at the same time, store rules have led to events appearing particularly for installed users, while the share of “new users” exposed to featurings decreased.

While Google is expected to continue developing Spaces, YouTab and EngageSDK-related placements in 2026, Apple has not hinted at any particular plan to build new featuring placements in the App Store, nor at any rule changes to help apps promote their services organically to new users. In fact, it is more likely that Apple will expand its logic to further boost the visibility of installed apps in the App Store and beyond when considering that one of the key promises of Apple Intelligence (now expected to have major improvements sometimes in 2027 with a Siri overhaul) was to help users get more out of their (installed) apps.

In this context, non content-first apps in particular will have to be ingenious in how to build In-App Event calendars to still fight for some of this App Store browse visibility, for instance by further studying seasonal activities in their user base and linking evergreen functionalities to real-world events.

Will Apple and Google break their stores between apps and games?

In one of the most curious ASO moves of 2025, Apple launched a new Games app as part of iOS26, meant to act as a bridge between the App Store for new game discoverability, and Game Center for social gaming and player engagement.

Google Play, while not going as far, built a very differentiated experience in its new “You tab” between user profiles it would label as “gamers” and “non-gamers”, and announced the LevelUp program for game publishers, which will likely further boost the adoption of Play Points among games in 2026.

A full separation of apps and games into distinct stores on the App Store does not appear likely in 2026. That said, the introduction of the Games app raises important questions around whether it can generate incremental visibility or engagement, and which gaming-specific features could ultimately help developers increase revenue.

Should Apple follow in Google’s footsteps, the creation of a loyalty program similar to Play Points could open the door to new visibility opportunities dedicated to games, as well as monetization tactic adjustments.

What impact could alternative payment methods have on app monetization in the App Store?

In recent years, global regulators have introduced new requirements aimed at increasing competition in mobile app ecosystems — including changes that impact how in-app purchases are processed. As a result, several regions are beginning to allow developers to integrate alternative payment options alongside Apple’s in-app purchase system.

As these changes take effect in 2025, it will be important to watch how major apps respond. Some may explore external payment providers as part of broader monetization strategies, while others may continue to rely on Apple’s integrated solution, which offers a consistent and trusted experience for users. The impact of these choices may vary by app category and region — depending on user expectations, business models, and conversion dynamics.

Apple has previously introduced programs such as the Small Business Program and long-term subscription pricing tiers that offer reduced commissions under certain conditions. It’s possible we’ll see continued policy evolution as the industry adapts to a more flexible payment landscape.

Conclusion

After the early signs of 2025, I believe 2026 could mark the start of a new cycle for ASO with new AI applications bringing significant changes to app discoverability mechanics and further tailoring of marketing messaging to specific user intent. Should this intuition be proven right, ASO practitioners will be challenged to embrace the switch from keyword matching to semantic matching, both inside app stores and other platforms like answer engines such as ChatGPT, while keeping an eye on how custom pages can be matched to their corresponding intent.

The comparative evolution of apps and games discoverability, as well as diversification of acquisition and payment funnels, will also be important trends to keep an eye out for in 2026. This will mean top ASO teams will have to be ready to tackle more diverse challenges than ever before, while benefiting from regained interest from other stakeholders.

Sukanya Sur

Sukanya Sur

Anthony Ansuncion

Anthony Ansuncion

Oriane Ineza

Oriane Ineza