ASO Review #4: Hotels.com vs Booking.com

Welcome to another ASO review!

In November 2020, we started a series comparing the ASO efforts of two industry leaders from the same category, challenging them to a head-to-head ASO matchup.

Discover our last ASO review on two leading dating apps

After a tough year marked by strict travel regulations, the travel and hotel industry is slowly recovering from the impact of COVID-19. Since the vaccine roll-out began, more and more tourists have been taking the opportunity to travel during their summer holidays. In this ASO review, we will take a closer look at two mobile apps from the travel industry to understand the impact of COVID-19 on their daily downloads and establish whether they have been actively updating their metadata to get ahead of the competition.

To present relevant key takeaways, we have chosen two apps that are very similar in terms of performance and core product. In this head-to-head matchup, we will compare the ASO efforts of Booking.com and Hotels.com, both of which are leading apps in hotel reservations. We will focus on the following metrics for both iOS apps in the United States to try and declare a winner:

- App power

- Estimated downloads

- Current metadata and creatives

- Recent metadata/creative updates

- Keyword growth

- Ratings & reviews

App power & download estimates

App power is a performance score developed by AppTweak to measure an app’s popularity in the stores. The higher the app power, the more authority an app has and the easier it will be to rank on certain keywords. The app power accounts for daily downloads, overall category ranking, and the varying competitiveness between different categories.

With an average score of 98, Booking.com has consistently held a higher app power than Hotels.com. However, Hotels.com is getting closer to its competitor: since Jan 1, 2021, Hotels.com’s app power has increased by 25%.

Both apps were negatively impacted by the second wave of the pandemic as we see decreasing app powers from the end of October until the start of 2021. Booking.com’s app power moderately decreased by 3% whereas Hotels.com suffered more than its competitor, decreasing by 11%.

Nonetheless, both apps’ app power quickly rose again from January 2021 and have remained quite stable since April. The gap between both apps is getting smaller: in one year, the difference between their respective app powers has decreased by 44%.

.png?auto=format,compress&q=75&w=1200) To no surprise, AppTweak estimates that Booking.com has the highest number of installs. For both apps, download estimates experienced the same drop at the end of 2020 as their app powers, showing the close correlation between the two metrics.

To no surprise, AppTweak estimates that Booking.com has the highest number of installs. For both apps, download estimates experienced the same drop at the end of 2020 as their app powers, showing the close correlation between the two metrics.

Since January 2021, both apps’ downloads have risen again. From December 2020 to July 2021, both apps’ downloads doubled.

With the highest app power and downloads, Booking.com is the winner of this round!

Metadata & creative updates

Next, we will consider the ASO efforts these apps have made to increase their organic installs. Looking more closely, we can use AppTweak’s Timeline tool to dig into the metadata changes for both apps in the last twelve months to learn more about their ASO strategies.

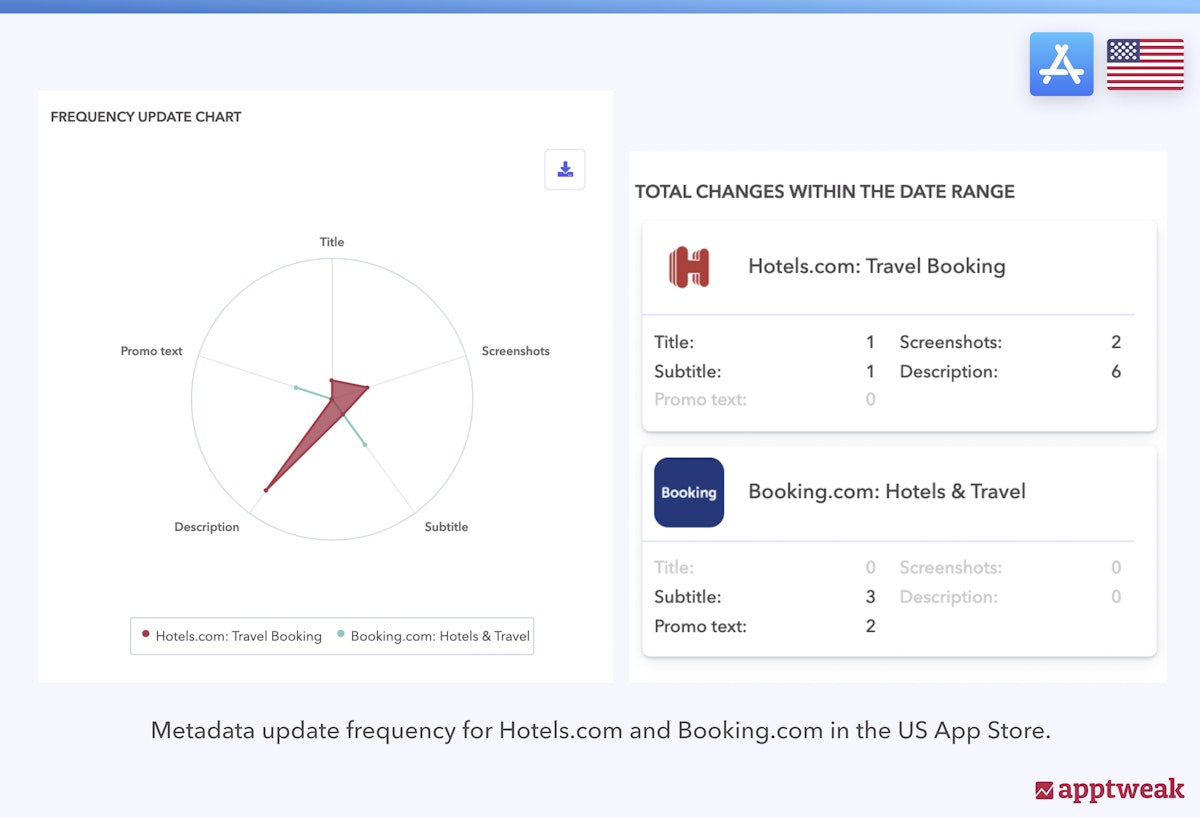

Both Booking.com and Hotels.com made few updates to their metadata in the past year and neither made any changes in the past six months. While updating descriptions and promo text can impact an app’s conversion rate, the keywords included in these sections do not impact the App Store ranking algorithm. At first glance, it seems Hotels.com has been more active, however, from a keyword optimization perspective, both apps are on the same level.

Both Booking.com and Hotels.com made few updates to their metadata in the past year and neither made any changes in the past six months. While updating descriptions and promo text can impact an app’s conversion rate, the keywords included in these sections do not impact the App Store ranking algorithm. At first glance, it seems Hotels.com has been more active, however, from a keyword optimization perspective, both apps are on the same level.

Remember – we are not able to see the hidden iOS keyword field so it is possible that keyword field updates were made for each app.

Booking.com

Subtitle

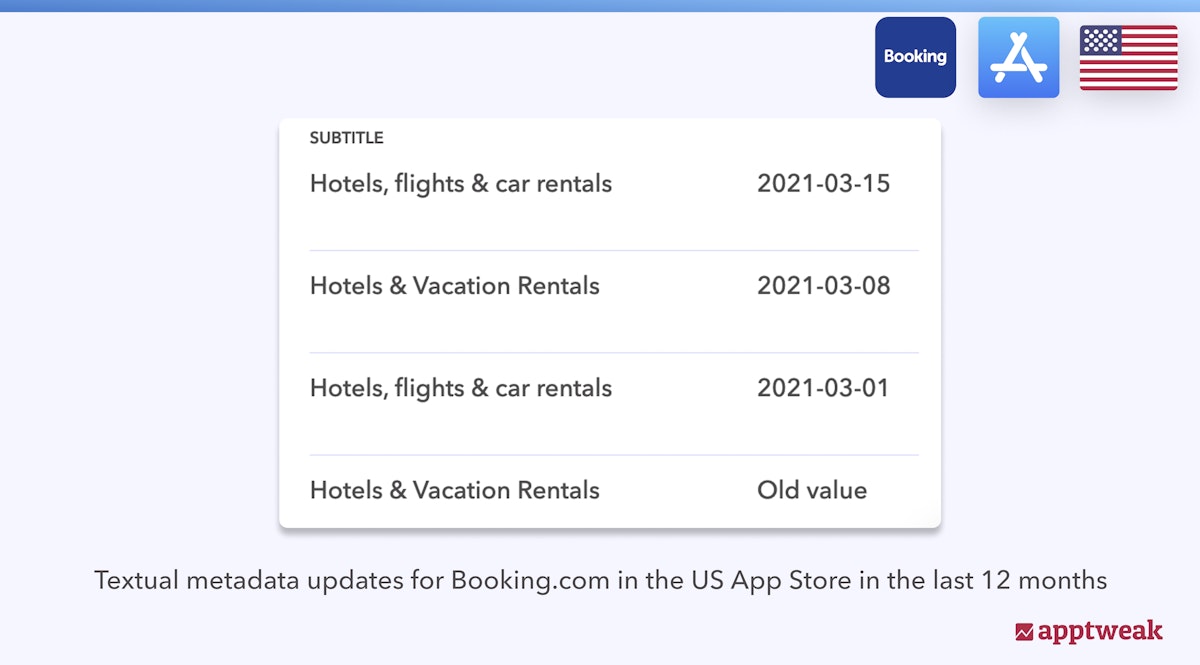

In March 2021, Booking.com ran several tests on two versions of its subtitle – one included the term “vacation rentals” and the other one included “flights & car rentals”.

In March 2021, Booking.com ran several tests on two versions of its subtitle – one included the term “vacation rentals” and the other one included “flights & car rentals”.

On the one hand, adding “car rentals” and “flights” did increase Booking.com’s ranking on these keyword combinations; on the other hand, the app did not reach the top 10.

After removing the keyword “vacation rentals” from its metadata in March 2021, Booking.com was pushed out of the rankings for this search term despite ranking in the top 5 in February 2021. We estimate this keyword combination generated 11 daily organic installs; Booking.com lost installs after removing keywords and didn’t gain any installs from new ones.

Title

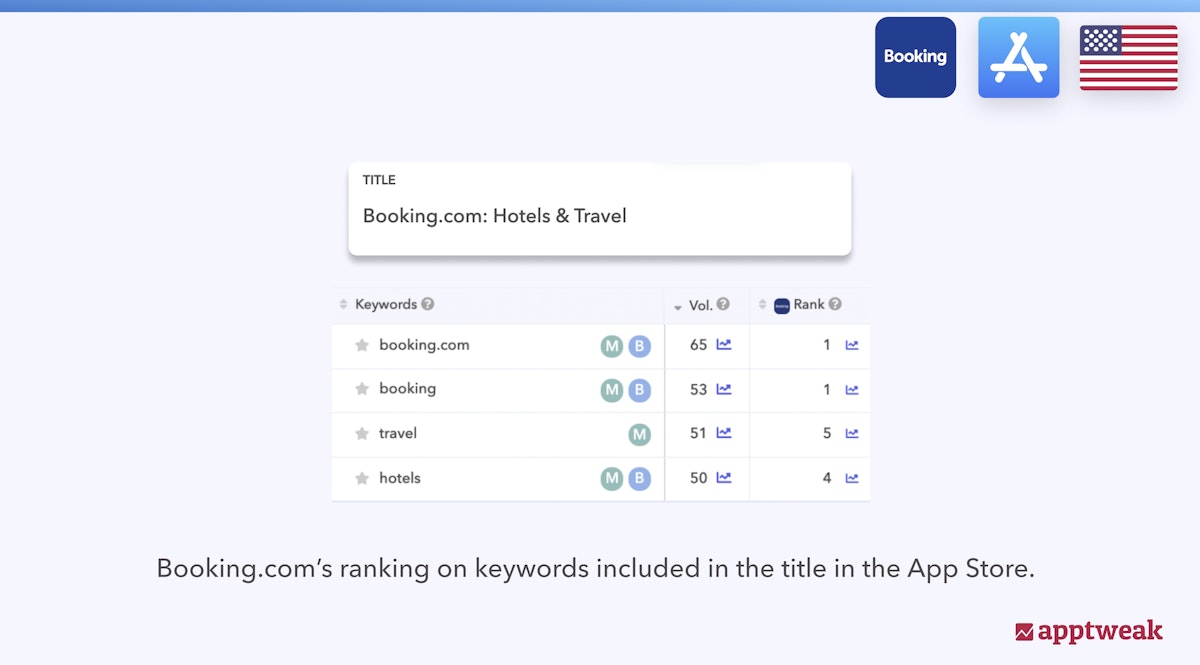

Although Booking.com did not update its title in the past year, we will still consider the keywords targeted here. Besides being a very well-known hotel booking app, including the popular generic keyword “booking” in its brand name extends its visibility.

”Travel” is a great term to target in the title as it is relevant to the app and has a high search volume. The App Store algorithm does not account for keyword repetition when attributing the app a position in the search results. Therefore, even though the keyword “hotels” has a very high search volume, adding it in both the title and subtitle will not increase Booking.com’s visibility on this keyword. Booking.com should therefore include a different relevant keyword to increase its visibility on a range of search terms.

”Travel” is a great term to target in the title as it is relevant to the app and has a high search volume. The App Store algorithm does not account for keyword repetition when attributing the app a position in the search results. Therefore, even though the keyword “hotels” has a very high search volume, adding it in both the title and subtitle will not increase Booking.com’s visibility on this keyword. Booking.com should therefore include a different relevant keyword to increase its visibility on a range of search terms.

Booking.com ranks #1 on its brand name and #4 on its competitor’s brand name, “hotels”.

Hotels.com

Title

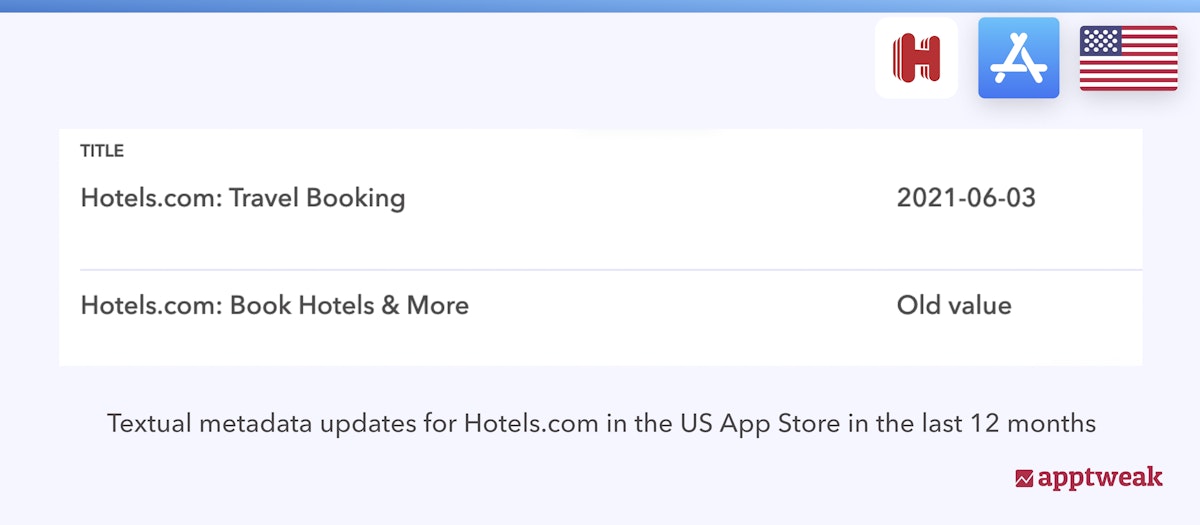

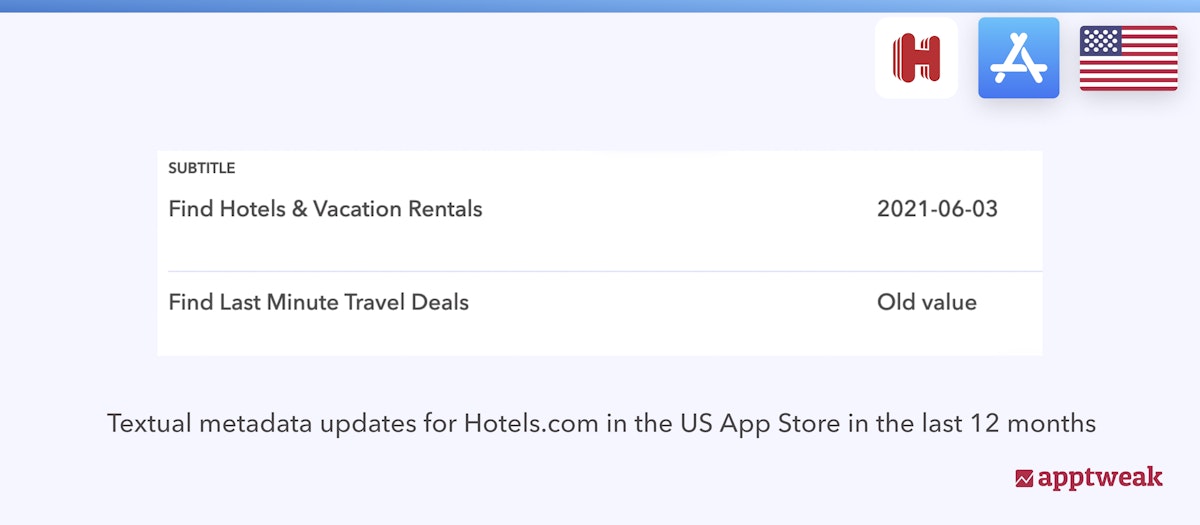

We will now look at the updates made by Hotels.com in the last 12 months. The app changed its title, removing “book hotels & more” to instead add “travel” followed by its competitor’s brand name, “booking”. Removing “hotels” from Hotels.com’s title was a great decision since repeating keywords will not help to increase an app’s visibility on the App Store.

We will now look at the updates made by Hotels.com in the last 12 months. The app changed its title, removing “book hotels & more” to instead add “travel” followed by its competitor’s brand name, “booking”. Removing “hotels” from Hotels.com’s title was a great decision since repeating keywords will not help to increase an app’s visibility on the App Store.

From a volume score perspective, Hotels.com made the right decision removing “book hotels & more” since these keywords are not often searched for. However, adding the keyword combination “travel booking” may not have been the best option as it also has a low volume score.

Hotels.com already included “travel” in its subtitle but moved this keyword to its title. This does not seem to have had a particularly positive impact; the app’s ranking stayed stable but Hotels.com lost 9 daily installs. The single keyword “booking” has a very high volume score but Hotels.com was already ranking in the top 2 and is unlikely to rank above Booking.com for this term.

Hotels.com added a whole new set of keywords to its subtitle: “hotels” and “vacation rentals”. Hotels.com might have seen an opportunity to target the keywords that Booking.com removed from its subtitle to increase its ranking for those keywords.

While targeting “vacation rentals” is both relevant and strategic for Hotels.com, adding “Hotels” twice to its subtitle is counterproductive. As Hotels.com is already ranking #1 for its brand keyword, it misses out on some opportunities to rank for more high-volume keywords.

While targeting “vacation rentals” is both relevant and strategic for Hotels.com, adding “Hotels” twice to its subtitle is counterproductive. As Hotels.com is already ranking #1 for its brand keyword, it misses out on some opportunities to rank for more high-volume keywords.

Hotels.com’s ranking remained stable for the keyword combination “vacation rentals” but gained one daily organic install. Its visibility increased for the single terms “rentals” and “vacation”.

Hotels.com has made more impactful metadata updates in the last year and targets more high-volume keywords; therefore, Hotels.com wins this round!

Screenshots

In the App Store search results, apps are listed with their icon, title, subtitle, and first three screenshots in portrait format. Therefore, it is crucial for apps to be particularly careful in those first three screenshots: apps should raise users’ interest by communicating a clear value proposition and an appealing design.

Both apps use their screenshots to highlight in-app features and functionalities. Besides using divergent orientations, their designs are quite different. On the one hand, Hotels.com’s screenshots are more colorful and busy; on the other hand, Booking.com presents its app through minimalistic and plain screenshots.

Hotels.com

With centered text written in red and outlined by a white border, Hotels.com drives users’ attention to its headlines. As opposed to Booking.com, the phone only takes up a third of the space available. Adding a lobby character makes their screenshots more lively and provides a sense of high-quality service.

While Hotels.com decided to focus on the text, they use varying font sizes for this text that is quite long in length. They include even more text lines at the bottom of the screenshots. Shorter and more straightforward sentences would help users understand its value proposition faster.

The app functionalities shown could be better emphasized: the phone displays a lot of information written on the screen so it is less easy for users to identify the app’s benefits.

Booking.com

Booking.com has chosen a simple, plain set of portrait screenshots, with a landscape screenshot added in the sixth position. They display an iPhone screen with a zoom-in effect to outline the app’s core features. Booking.com focuses the users’ attention on the iPhone screen which takes up 70% of the space available.

The headlines and varying phone positionings guide users towards the last screenshot. Booking.com might have chosen to add a landscape screenshot to further attract users’ attention. However, they may not have realized that this landscape screenshot would be displayed in portrait orientation.

Zooming in on one particular feature allows Booking.com to ensure users understand the app’s core features and are not distracted by other elements.

The value proposition is clearly stated from the first screenshot. Each screenshot headline is short and straight to the point.

Here, we declare Booking.com as the winner because its value proposition is well communicated from the first screenshot.

Ratings and reviews

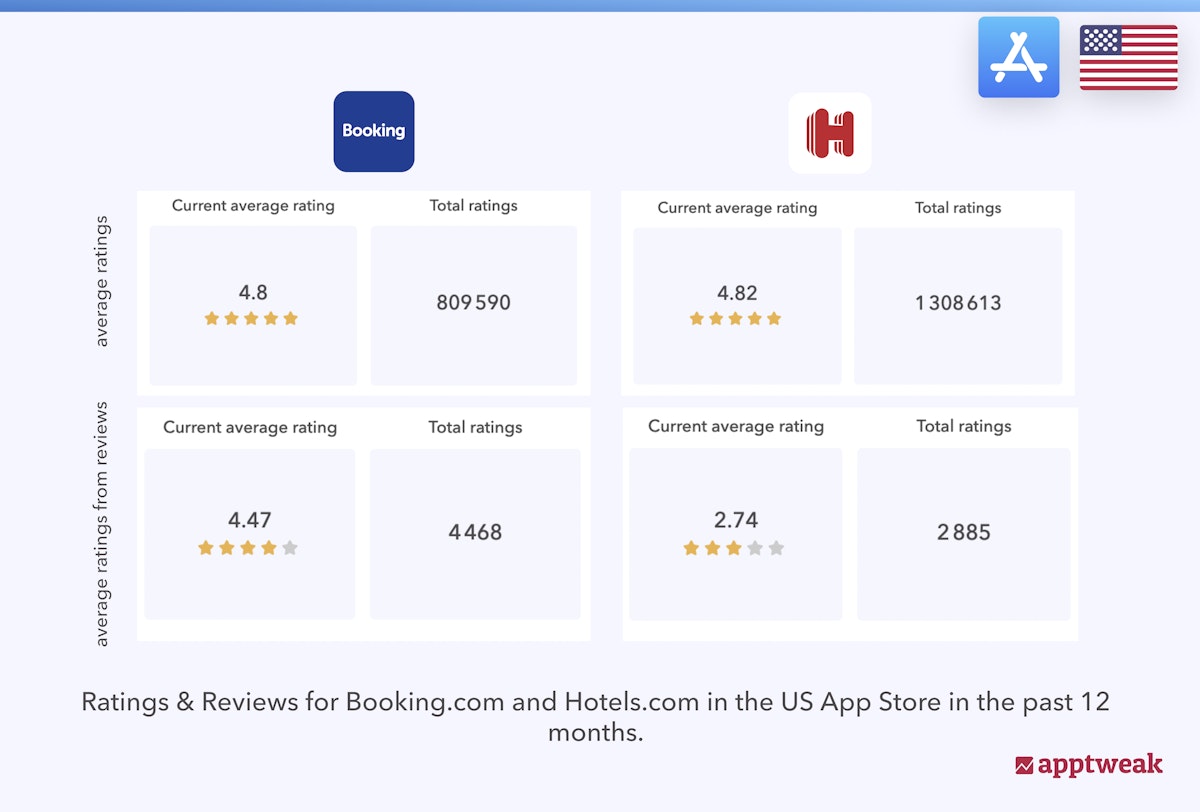

Hotels.com currently has the highest rating of 4.82 and has far more ratings overall. Booking.com also has a very good rating of 4.8. However, in terms of ratings from reviews, Hotels.com has a much lower score of 2.86. Having positive reviews is an important element for conversion and, as such, Booking.com is performing better in reviews.

Hotels.com currently has the highest rating of 4.82 and has far more ratings overall. Booking.com also has a very good rating of 4.8. However, in terms of ratings from reviews, Hotels.com has a much lower score of 2.86. Having positive reviews is an important element for conversion and, as such, Booking.com is performing better in reviews.

Besides improving customer support and increasing their ratings, apps can rank higher on the keywords included in their reviews. Currently, neither app regularly replies to its reviews.

Because of Booking.com’s high average rating scores, we will declare them the winner of this section.

Keyword rankings

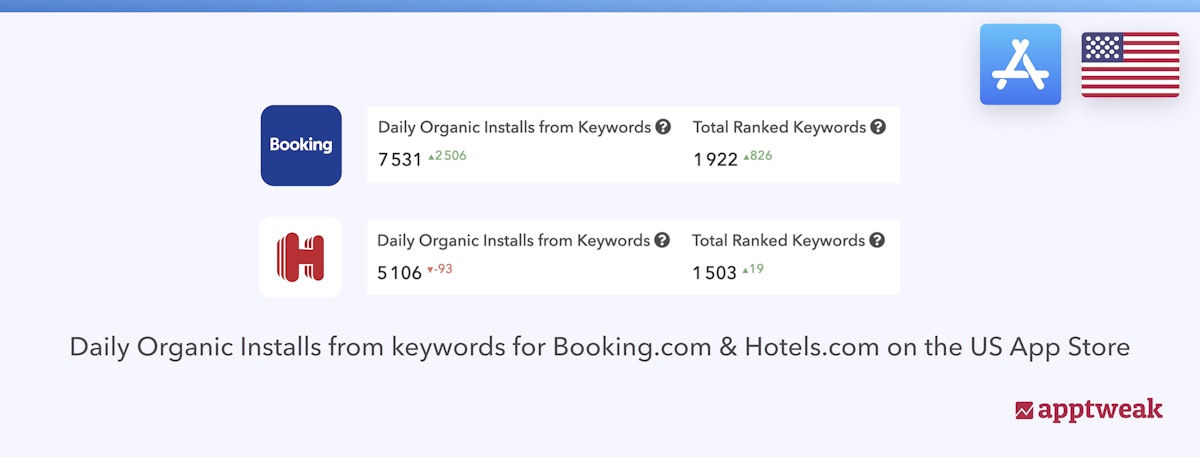

To determine which app has produced the biggest results for its ASO efforts, we look back to its keyword install growth from one year ago – July 2020 – compared to now.

Booking.com ranks on more keywords and gains more organic installs than Hotels.com. Both apps have seen a great increase in organic installs and ranked keywords thanks to their brand popularity. As users have started traveling again after the COVID-19 pandemic, brand keyword search volume has organically increased and boosted the visibility and installs of both Booking.com and Hotels.com.

Booking.com ranks on more keywords and gains more organic installs than Hotels.com. Both apps have seen a great increase in organic installs and ranked keywords thanks to their brand popularity. As users have started traveling again after the COVID-19 pandemic, brand keyword search volume has organically increased and boosted the visibility and installs of both Booking.com and Hotels.com.

Conclusion

Each app is very powerful and well-positioned in the overall market. Although they have not recently been very active in ASO, it is worth analyzing the impact of each app’s metadata updates.

Booking.com includes new high-volume keywords in its subtitle at the expense of losing its high position on “vacation rentals”. Hotels.com, on the other hand, was able to obtain more results from its metadata updates. By targeting keywords its competitor removed from its subtitle and adding high-potential keywords, Hotels.com seems to have taken more strategic decisions.

Even if both apps include high-volume keywords in their metadata, there is still room to target search terms more effectively. Repeating keywords does not increase apps’ rankings on the App Store. By adding “hotels” to their title and subtitle, Booking.com and Hotels.com are losing opportunities to target other relevant keywords.

While Hotels.com has a higher average rating, they receive poorer ratings from their reviews. Booking.com’s average rating is slightly under Hotels.com but ratings coming from their reviews are quite close to its average rating.

Though Booking.com has better visibility and generates more organic downloads, they have not recently been very active in ASO and so are not in the position of winning this ASO review match.

Stay tuned for the next edition of AppTweak’s ASO Review Series where we’ll take a deeper look into two more apps, measuring the effectiveness of their ASO efforts and store listing updates.

Discover how AppTweak can help you to fuel growth for your apps and games worldwide by providing actionable insights in a simple interface.

Oriane Ineza

Oriane Ineza

Alexandra De Clerck

Alexandra De Clerck

Jane Jin Pak

Jane Jin Pak