What to expect for ASO in 2021

The transition to a new calendar year is often a good time to reflect on the past 12 months and make predictions for the new year. As a result, our ASO Experts took time to review what were the big ASO changes of 2020 and discuss what they anticipate would happen in app stores in 2021. From privacy and antitrust challenges to broader topics and bolder predictions, find out below what our team anticipates for ASO in 2021.

Making a final review on 2020: a transitioning year in ASO

Last year, we had predicted recommendations would become more crucial, keyword strategies more complex, creative optimization would turn to video, while also becoming less product and more marketing oriented, and ASO practitioners would add more data with particular interest on matching store and attribution tools data. With 2020 now passed, it seems most of our calls were right, and fueled a larger trend in how ASO is still evolving, transitioning into a new role.

- Recommendations have become more crucial:

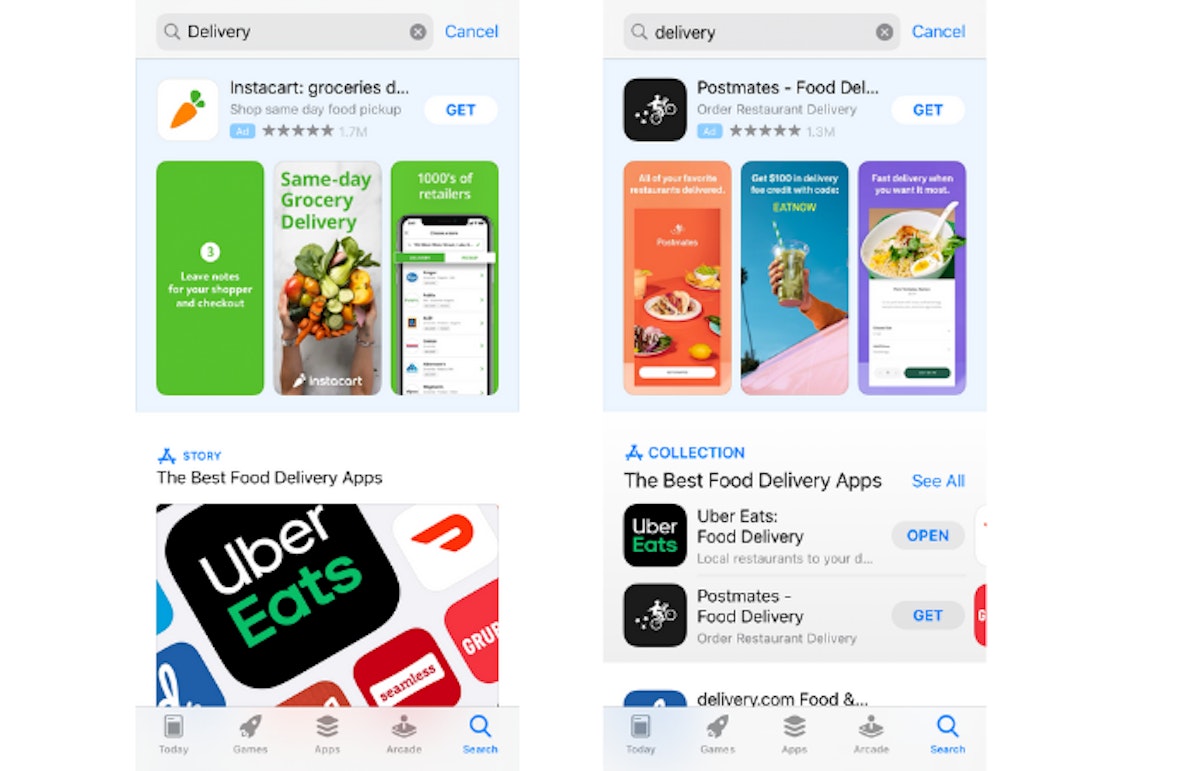

Apple revamped the display of app collections between iOS 13 and iOS 14

Apple revamped the display of app collections between iOS 13 and iOS 14

On iOS, Apple increased its efforts around “app collections”, providing even more content about featured apps and changing the search results UI to better drive installs to apps sitting at the top of each collection. On Android, Google has yet to publish a 2020 Google Play Public Policy report to follow the 2019 version, but in our observations, explore traffic remained a key driver of app installs, with efforts around video benefitting the Play homepage in particular.

- Keyword strategies are more complex:

In 2020, we’ve seen more competition around keyword optimization overall, not just in the “usual” markets of Northern America and Western Europe, but especially more and more in “new trending markets” in Asia and Eastern Europe for instance. At the same time, ASO has become puzzling with more and more people asking why their app does not rank for certain terms in particular, leading ASO practitioners to try and measure for redistributed influence between indexing and ranking factors while also having to educate on ASO being only rarely an instant growth booster, but more often a requirement apps need to build upon.

- Creative Optimization has yet to focus substantially on video:

Although the end of 2019 had provided signs video could become a new focus for conversion rate optimization, video was a relative bust in 2020. Google Play did in fact activate autoplay on Play Store videos, but only in the Play Store homepage as it would seem, while store listings offer a more seamless experience in encapsulating the YouTube video but still require a tap on the Feature Graphic to play. At the same time, Apple did not announce any effort to offer the same video experience in regular apps’ product pages as for Apple Arcade, and overall most developers have remained shy to engage in video optimization, most likely as a result of high production costs in a year marked by Covid that led to more difficult coordination of creative teams.

- Creative optimization revolves less around product features and more around benefits and promises

In a year of global pandemic and lockdowns, content has been king for apps with people looking for ways to adapt to working from home and/or to reinvent their hobbies through apps. Creative optimization followed with apps and games making more efforts to not simply describe their products, but better highlight the benefits for users. The result was a widespread effort to contextualize specific features such as social features from PvP to Guilds in mobile games, or doorstep delivery in food & drinks apps, while at the same time it was not dominated by traditional marketing attempts for eye-catching creatives that we thought might make a comeback in 2020.

- ASO practitioners looked to add more data with particular interest on reconciling store console information with attribution tool data

While this trend did not start in 2020, the revamp of the Google Play Console and particularly the merging of organic and paid store search traffic and explore traffic was a considerable challenge that led many ASO and UA teams to try and figure out how to truly measure the impact of their respective efforts. At the same time, Apple’s decision to implement the App Tracking Transparency framework in Q1 of 2021 has also raised the question of what data ASO could provide to help UA overcome the challenge of targeting the right user profiles without lookalike audiences fueled by downstream conversion events.

Anticipating ASO for 2021: staying the course and preparing for uncertain changes

Overall, 2020 was a year that came with its challenges for ASO as for all other disciplines of the app industry, but eventually did not bring any majorly disruptive change in search results display or browse/explore content. However, it seems to have been a transition year for the role of ASO practitioners, with a continuous increase of ASO positions across app companies and a renewed challenge for ASO practitioners to ascertain their specific roles at the crossroad between marketing and product teams. 2021 should start with the same trend, as ASO will be impacted by the larger topics of user privacy and antitrust investigations in Apple & Google, but could also bring a new wave of App Store changes.

ASO will play a supporting role in the transition to a post-IDFA user acquisition

The question of how marketers will adapt to a post-IDFA mobile industry is bound to dominate the first half of 2021 after Apple announced it would delay the mandatory implementation of the App Tracking Transparency framework to Q1 (with several UA experts now announcing it will probably be scheduled for March). In that context, marketing teams will explore possible options to compensate less precise targeting, including ASO:

- UA teams turning to Apple Search Ads will benefit from the help of ASO.

With already many discussions in UA about the relevance of shifting more budget towards Apple Ads, some teams will take notice of Apple’s statements on how ASO can benefit Search Ads and aim to sharpen their keyword strategies by leveraging metadata and organic traffic to improve their relevance for target keywords, thus maximizing their exposure and control app install costs.

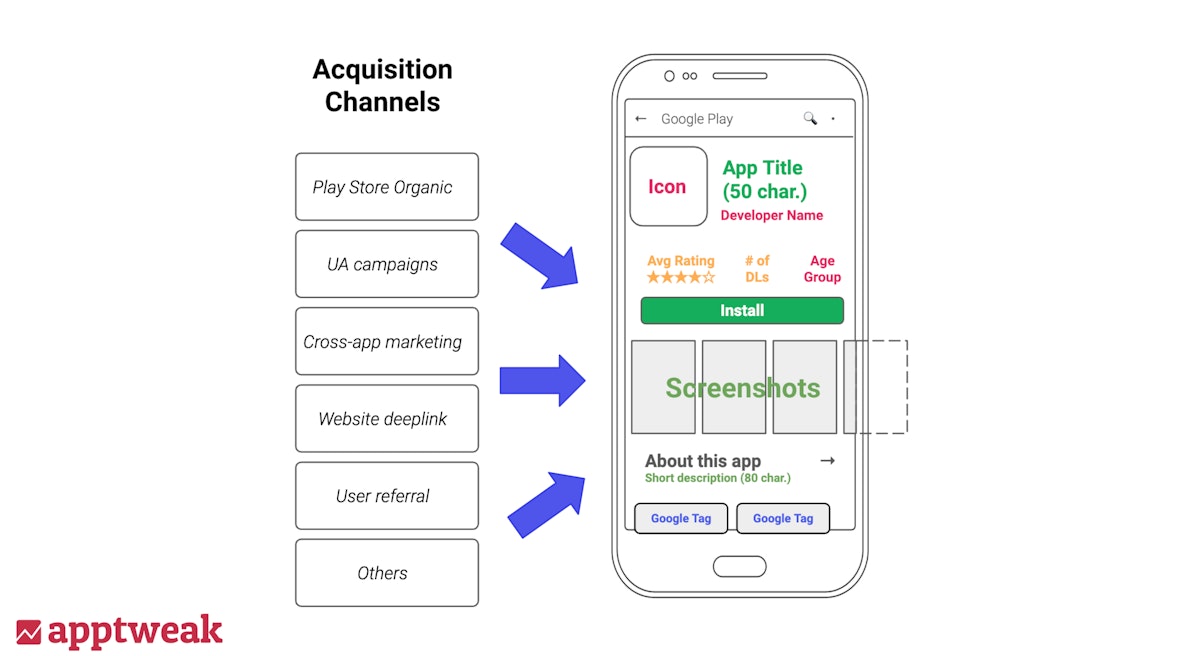

- Marketing teams as a whole will aim to better align UA campaigns and app store assets:

UA and organic traffic all lead to the store page, making it the most efficient step of the funnel to optimize.

UA and organic traffic all lead to the store page, making it the most efficient step of the funnel to optimize.

As ad networks targeting capabilities become less effective, UA managers will need to maximize conversion, at first through the large spectrum of all the different types of users landing on their app’s product page, then progressively focusing on screenshots converting well for active users yielding the best ROAS. As a result, part of the resources previously invested for UA creatives will be shared with ASO teams, leading to app store screenshots becoming even more of a combination between product insights and UA designs.

- Large companies will give more attention to ASO and how to use it for asserting their brand.

Companies who have already established their brand as differentiating element will mostly turn to ASO to give it a brand first tone while they assess how their overall marketing strategies should change. This approach will likely give mixed results, as some brands will benefit from conversion uplifts, but other fail to really stand out of the mix and give less weight to generic traffic at the same time.

- Growth teams will investigate how ASO can provide soft signals on customers’ expectations and behaviors.

Needing to make up for some lost information and ascertain what advertising channels could help them grow outside of the major ad networks, growth teams will start considering certain ASO data such as keyword volume or customer reviews for assessing what contextual advertising channels would be relevant.

Stores will work on “justifying” their behaviors and fees, possibly leading to new opportunities for ASO “hacks”

2021 begins in the midst of an ongoing PR battle in which Apple (and Google, in a lesser measure) have to justify their app store fees and policies in the wake of newly voiced criticisms by the App Fairness coalition and antitrust investigations in both the European Union and the United States. As a result, a second trend for ASO in 2021 is that we expect both tech giants to roll out new features and revamp algorithms and/or policies in their respective app stores to address critics and deter legislators from taking drastic measures.

- Apple will invest even more in its curation role for the App Store:

It’s quite likely Apple will add more to the latest curation related features released in iOS 14 (revamped app collections, suggested apps in search), especially after having publicly disclosed more people had been hired for the iOS curation team. More importantly, curation efforts will have to broaden the spectrum of apps being featured to not only promote established apps but also turn to smaller developers or early success stories.

- Apple will continue adding more app store marketing tools in App Store connect:

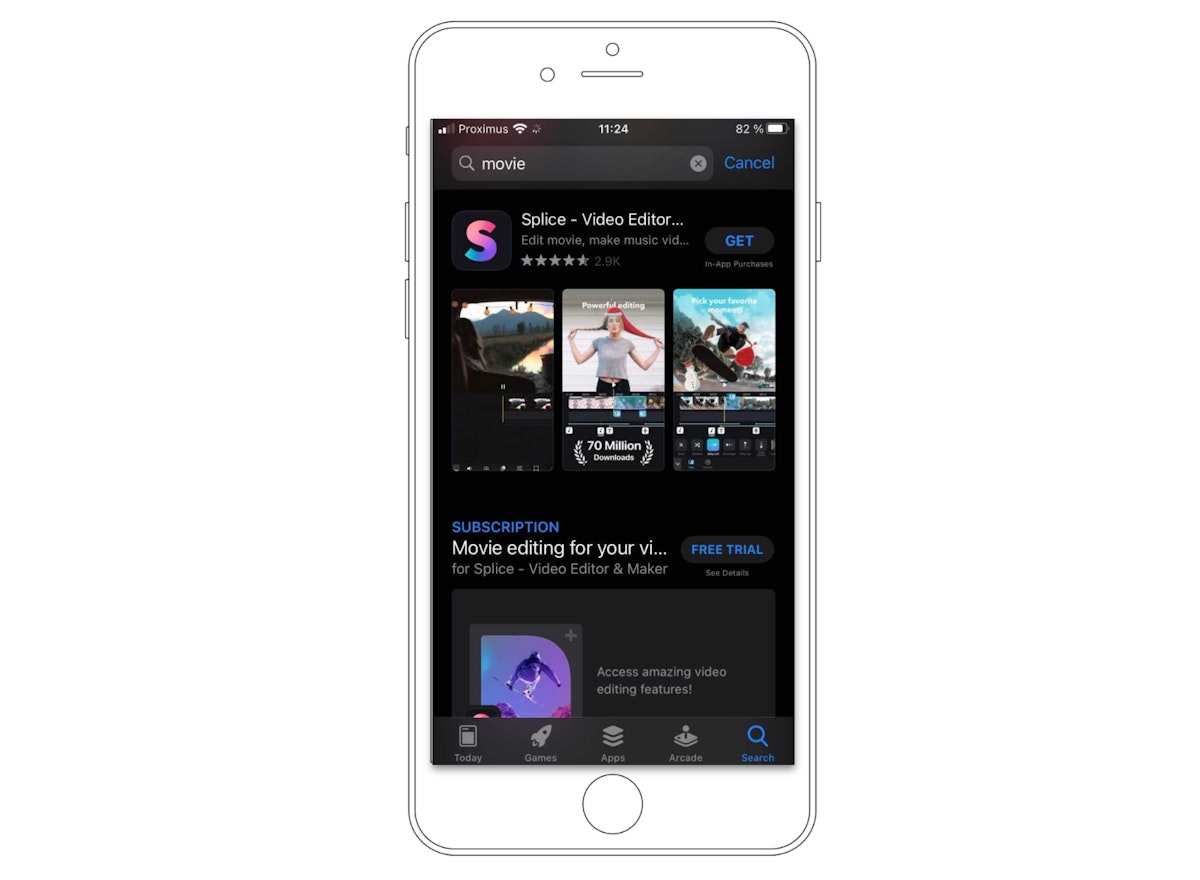

Subscriptions and In-App Purchase packages have started to appear more often in App Store search results

Subscriptions and In-App Purchase packages have started to appear more often in App Store search results

Following the first QR code generators released at the end of 2020 to help developers drive traffic to their app store page or iOS App Clips, Apple will offer more marketing tools within its console to gain goodwill from marketers. Subscriptions and IAPs will be given more spotlight, while in the long run Apple could also look into adding an automatic product page translation tool to App Store Connect.

- Depending on the swiftness of legislative processes in Europe and the US, Apple and Google will have to take measures to review the selection process of preinstalled apps.

While the timing for this is likely to be dictated by the pace of European Institutions (and therefore remain slow), it’s possible that Apple and/or Google will start auctioning spots for preinstalled apps providing standard smartphone functionalities, from text messaging and emails to possibly even music apps, weather apps, and more. This process would be an easy way for Apple and Google to reject legislator claims of playing favorites with their own apps, while still making money from competitors eager to fight for a larger market share.

- Apple and Google might revamp their app store categories in 2021:

While the move would not be much considered as a way to enable more developers to efficiently market their apps and more, but rather only as an already overdue update, revamping app store categories could well be on the table for 2021. Mobile game categories in particular but also several app categories now shelter very different products and services under the same name, and a revamped classification could benefit search algorithms more than introducing new layers like Google tried to do with Google Tags.

- With more questions being voiced over search ranking factors, Google will add new quality metrics to the signals influencing Play Store search.

Despite shying away from disclosing what are most of the factors influencing Play Store search rankings, Google has been vocal in the past about using app quality signals, and the addition of new quality metrics in the new Play Console is likely to be used in newer versions of the Play Store search algorithm. Furthermore, Google could reiterate these metrics are part of search algorithms as a way to differentiate their store from Apple’s curation approach.

More ASO changes could become reality in 2021, but should not be expected in a year full of uncertainty:

Although 2020 has stirred several major conversations around the app economy, the overall uncertainty imposes some caution when making certain bolder predictions that developers and marketers should prepare for but not necessarily expect to become true within the next 12 months:

- The end of unified search results is not truly there yet:

While it’s already been observed that not all users get the same search results after entering the same search query, the time for truly personalized search algorithms is probably not there yet. Apple and Google will both keep experimenting on how search algorithms can be improved for more user-centric results, but keep displaying one version of search results to the vast majority of their users. Doing differently would indeed risk bringing too much attention to the matter and being forced to disclose much more information on how their search algorithms operate, while at the same time the implied challenges of completely changing algorithms’ formulas are not without costs.

- Debates will continue over the need for a 3rd major app store, but won’t crown Huawei’s App Gallery as the unquestionable 3rd player despite growing adoption from app developers

Huawei will continue its effort to convince more developers to upload their app to their App Gallery, while also strengthening their position as one of the top smartphone manufacturer. As a result, more marketers will turn to the App Gallery for a 3rd option to explore, strengthening Huawei’s app store position as the most likely challenger for the iOS App Store and Google Play Store. However, political mistrust around Huawei in Western countries and the need for Apple and Google to retain as much control as possible over iOS and Android will prevent the App Gallery from reaching the same critical mass that would make it an unquestionable app distribution channel as soon as 2021.

- 2021 will see the rise of a new generation of apps for connected devices

Apple already started investing more in the development of Apple Watch apps with the latest updates to Apple Fitness, and will likely encourage developers to make more apps compatible with the watch.

Apple already started investing more in the development of Apple Watch apps with the latest updates to Apple Fitness, and will likely encourage developers to make more apps compatible with the watch.

With 5G availability expected to increase, 2021 is likely to see the start of a new generation of apps aimed not only at a smartphone audience but also compatible with more connected devices. However, considering most customers will not be equipped yet with many of these devices, a complete pivot from “traditional” app stores to “smart-device first” is unlikely in the next 12 months.

In conclusion, major ASO trends that have already started affecting ASO in 2020 are likely to have many consequences in 2021, continuing the transformation of ASO in a fully growth-minded process at the crossroad between marketing and product teams. At the same time, ASO practitioners will have to anticipate and adapt to upcoming changes that remain uncertain.

Stay tuned and keep a close eye on our social media as we’ll continue to communicate regularly about the latest ASO changes and their concrete impacts in 2021. Want to closely monitor your keyword rankings or keep a close eye on your competitors? Sign up for a 7-day free trial!

Sukanya Sur

Sukanya Sur

Oriane Ineza

Oriane Ineza

Micah Motta

Micah Motta