Apple’s privacy updates and the Impact on ASO

Privacy has become an increasingly popular topic for mobile users in the last two years, leading to legislators introducing regulations such as COPPA in the US and GDPR in the EU. Many companies have also identified the topic as a major user concern, with some taking actions beyond regulatory standards and making privacy part of their core product benefits.

Last week, Apple put a large focus on privacy during presentations at its WWDC online event, including several impactful privacy-related product updates that will roll out in a few months as part of iOS 14. In the wake of these announcements, we thought we’d take a closer look at the potential role of ASO in privacy-friendly user acquisition.

The impact of privacy on ASO so far

While the correlation between ASO and user privacy has not been studied much so far, it would be wrong to assume the two have never had anything to do with each other:

- As privacy has become a growing concern especially in Western markets, its first impact on ASO is the growing traffic from privacy-related keywords and the potential impact on conversion from screenshots that show privacy-related benefits.

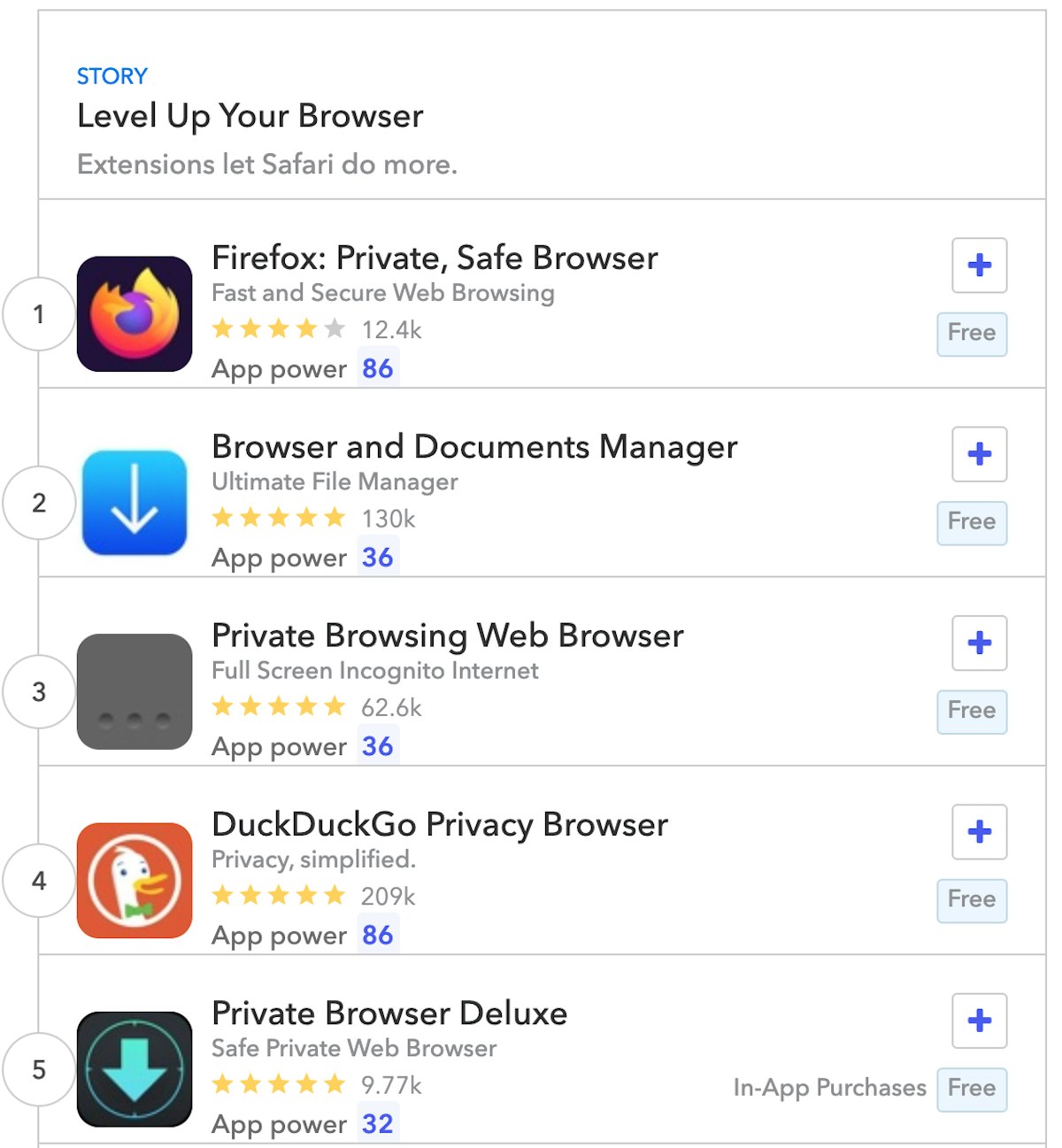

4 of the first 5 apps displayed in Apple’s App Store search results for “browser” in the US on June 25th include the word “private” or “privacy” in their title.

- Following the increase in regulations, Apple and Google have both reinforced guidelines on user privacy and introduced new grounds for rejecting app submissions, with some of these new guidelines focusing on childrens’ apps. As a result, developers have had to provide additional information on their store console a few times in recent years (for instance, disclosing whether their app targets younger audiences and ensuring the ad networks they may use are approved by Apple). Most of the changes did not appear to have a direct impact on end users. However, an indirect impact of Android apps being required to indicate if minors are a target audience led to the apparition of a parental guidance logo on the Google Play app product page.

- On Google Play, developers choosing to remove intrusive SDKs from their app might benefit from a small boost in app visibility as smaller app sizes are considered a positive Android vital by Google’s algorithms.

Understand the differences between ASO on the App Store compared to on Google Play

Upcoming privacy changes on iOS and their impact on User Acquisition could create a new role for ASO

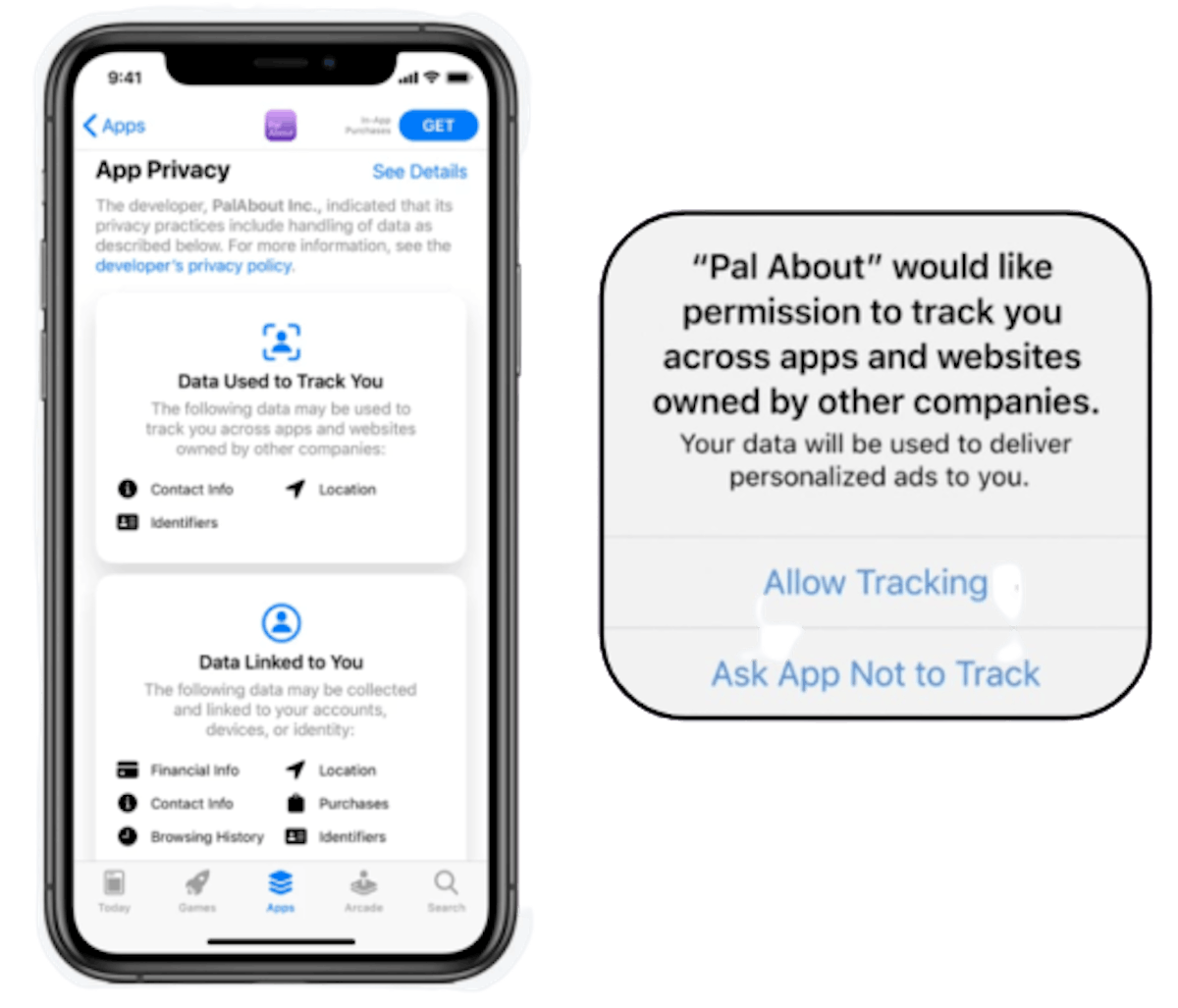

During WWDC 2020, Apple announced that iOS 14 will require app pages to include a privacy card detailing the access required for the app to operate, and more importantly that users will have “Limited Ad Tracking” (LAT) activated by default.

iOS 14 will include a Privacy section on the app store product page and the possibility for developers to prompt users to allow tracking.

While the change to LAT-on by default is likely to go unnoticed by most users, it is expected to have major consequences on how UA is conducted in the future – it means that device identifier tokens, known as IDFA, will no longer be shared with third-party services. This could cause a seismic shift in UA as most advertisers rely on third-party attribution platforms that use IDFA to match clicks on ads with app opens to confirm that a user has installed an app, thus optimizing the performance of marketing campaigns regarding cost per install.

Learn what’s new with iOS 14 and the impact on your ASO work

Now, what does this have to do with ASO? Simply put, the likely factual disappearance of the IDFA – it will technically remain available for users who chose to opt-in – could force advertisers to rely more on App Store data and predictive modeling to understand where their users are coming from. To that end, ASO is likely to play a key role in both user acquisition strategies and predictive modeling:

- Monitoring store traffic and keyword trends with ASO tools could provide useful information to help data analysts understand the underlying phenomenon in the fluctuations of apps’ user bases.

- At the same time, closer coordination between ASO & UA managers (especially regarding creative optimization) will be key to making sure users can learn about some of the most valuable features driving retention. As a result, this will maximize conversion not just at the app install level, but also for downstream metrics. This could be an organizational challenge for many app companies since, even today, ASO and UA do not always work together and might have a siloed structure leading to optimizations on different messages and metrics.

Challenges ahead: the expectations for more data on store consoles

While the upcoming changes in attribution are likely to increase the importance of ASO, they do not solve the current issues for ASO practitioners. ROI measurement in ASO remains a complex topic, as ASO tools have already developed advanced estimation models but remain limited by the amount of data currently available in App Store Connect that fuels their estimations.

Understand exactly why ASO is a key element of your app growth strategy

Improving both the amount and the quality of data available on store consoles is therefore going to be the next big point of contention for Apple. Developers and marketers will likely have high expectations for further attribution metrics in the store console, especially after Google Play made some long-awaited improvements to its console. Of course, there is no way to know if Apple will make specific efforts to add data to App Store Connect or explore other options to bring privacy-friendly data to advertisers. However, another iOS 14 feature announced during WWDC could nudge Apple towards the idea of developing data capabilities in App Store Connect to make it the preferred performance measurement platform on iOS: App Clips.

App Clips will allow users restricted access to compatible apps without requiring downloads and will support seamless user registration and purchases via Sign In with Apple and Apple Pay.

App Clips will allow developers to give users partial access to their app without having to download it, giving them a taste of the product without even having to search for it. The benefits for improving the user experience of your acquisition funnel are evident and incontestable. But what has not yet been presented is how traffic and app installs coming from App Clips will be measured in App Store Connect, and with what level of data granularity.

Here we can only speculate, but it is likely that Apple will introduce new metrics to App Store Connect to show developers the value of App Clips, letting them measure the traffic they receive and how many app installs are driven by the new iOS 14 feature. Furthermore, with already developed integrations for App Clips in the “Messages” and “Maps” iOS apps, it is not impossible that Apple will encourage other apps to support App Clips sharing features as well.

If that were to be the case, requests will certainly arise to ask for measurement of where the most popular App Clips have been positioned, for instance, with a markup logic similar to UTMs on the web, using contextual information to determine the origin of users without collecting their personal data. Such a scenario, while purely hypothetical, could occur simultaneously or even be an alternative to the improvement of Apple’s SKAdnetwork, which has been on the minds of many UA specialists for how advertisers will receive data to optimize campaigns.

Were these changes to happen and give new weight to App Store Connect among mobile marketing tools, ASO could undergo a drastic transformation putting it at the center of growth strategies while at the same time transforming its very nature with a much higher emphasis on data analysis from store consoles.

In this blog, we highlighted the impact of Apple’s privacy updates on App Store Optimization, examining the role that ASO can play in a privacy-friendly user acquisition ecosystem. In particular, monitoring store traffic and keyword trends with ASO tools will be even more important, while closer coordination between ASO & UA managers will be a key part of maximizing conversion and retention.

Want to discover how you can use AppTweak’s ASO tools to fuel your app’s growth? Start your 7-day free trial now.

Sukanya Sur

Sukanya Sur

Oriane Ineza

Oriane Ineza

Micah Motta

Micah Motta